I was late to work and sneaking up the stairwell to my office. A passing friend said, “A second plane just hit the World Trade Center.”

There’d been a first plane? The World Trade Center? It must be a little Cessna.

The entire office huddled around televisions. I wasn’t prepared for what they were watching. The heroism of everyday people that day still amazes me.

Later in the week, among the flurry of stories echoing the disaster, one personal finance problem emerged: private financial documents with personal client information littered the streets of Manhattan. Many of the firms in the World Trade Center were financial companies (in fact, one firm owned by a cousin of a client, Alger Mutual Funds, lost David Alger and 35 other staffers that day). I began helping the media complete stories about “How to Protect Your Privacy.”

Although we can’t prevent another 9-11, we can make sure that our financial documents are the last thing we worry about when far more important concerns (such as people) should dominate our thoughts. Here are five lessons I took far more seriously after that day than I had previously:

5 Steps To Protect Your Identity

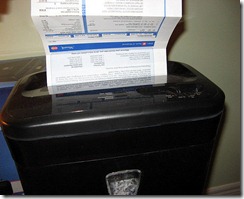

1) Shred unnecessary documents. A good shredder pays for itself immediately. If you’re using it for household bills, this Amazon shredder will only set you back $29.99. Businesses should invest in a more robust tool.

1) Shred unnecessary documents. A good shredder pays for itself immediately. If you’re using it for household bills, this Amazon shredder will only set you back $29.99. Businesses should invest in a more robust tool.

2) Don’t give out your social security number, telephone number, or other unnecessary information on documents. I hand over wrong numbers like a hot woman at the bar. Create a separate email address reserved for email forms and correspondence with companies.

3) Check your credit report regularly. You’ll want to keep a tight watch over predators trying to access your credit. Companies with free credit tools like Quizzle or CreditKarma are great places to monitor lender activity. On episode #2 of our Two Guys & Your Money podcast, Len Penzo reported that he turns off his credit with each credit company until he needs it. Look for other mistakes while you’re there: a recent ABC news story reported that over 90% of all credit reports have inaccurate information.

4) Review every credit card statement. Ever wonder why Mr. Monopoly looks shocked when you draw the “Bank Error in Your Favor….Collect $40” card in the popular board game? It’s because errors happen all the time and they’re rarely in your favor. More importantly, you may see early signs of thieves trying to gain access to your credit.

5) Back up your documents – I’ve recently begun transferring my paper documents into digital form. Keep these in two places in case you lose access to the first or thieves steal the data.

Foremost in my mind today is the tragic and unnecessary loss of life on 9-11. I learned far greater lessons than the five I pointed out above. However, I also learned a little about taking care of my financial life so that if tragedy strikes, the threat to my identity is minimized.

What steps do you still need to take to better protect your financial privacy?

I need to go though my old documents and shred the ones I no longer need. I also need to back up my computer.

Also be wary of photocopying sensitive documents. The hard drive in the copiers tend to keep a ton of the images they copy including your social security cards etc… I saw a report on it on one of those nightly news shows.

As far as checking your credit report I did a step by step guide on how to pull your free annualcreditreport.com report a while back.

We have a filing cabinet in our house that my wife and I go through each year to shred all of the unneeded information. I think we do a pretty good job of keeping things digital but we probably need to scan in other things and store them somewhere on the web.

Another tip is to stop the credit applications and junk mail from ever arriving. Sign up for e-statements too to slow down important info in the mail.

I need to better about using the shredder for documents at home. I hate to clean up the mess so ususally just rip things up. It would be a much bigger mess to clean up my credit if someone stole it though. Good reminder.

Just be sure if you’re backing up your documents that you password protect them with decent encryption.

I remember being at my parents’ place a few years ago and being shocked that they had ALL of their tax information in PDFs sitting in a folder on their desktop. Over five years of returns just free for the taking! Any digital thief would consider that a fantastic find with all sorts of wonderful illegal activities to potentially explore with it.

I also found the same thing on a friend’s computer before, with financial statements for their business and some personal bank statements too. That stuff is too important to risk, so take some precautions!

Great advice. I’ll bet that’s pretty common, Garrett. I remember plenty of financial advisors who’d have all these complicated passwords and then a word doc on their desktop with all of the passwords to get into everything (because they could never remember). Shocking.

I diligently check my credit report. Every single year. I need to do a much better job with shredding. Sometimes I am too lazy and it is not a good excuse. I use our shredder at work (it is a huge one) but I need to get one for home. Maybe then I won’t be too lazy anymore. 🙂

If you don’t have a shredder, a pair of scissors works just fine! Sorry to be a cheap-ass. Since we don’t have a home business (I mean, a BIG home business…blog doesn’t count!), we don’t have a ton of documents that need shredding. It’s not like I can’t keep up with all the shredding with my $4 scissors. In fact, I WELCOME that problem into my life. Please Karma, if you’re listening…please, please, please give me so many financial documents that I can’t keep up with the manual shredding. I will know then that I have arrived.

I love it! Instant savings!

It’s funny, though. Maybe I’m weird, but for $25 I love that crunching sound and feeling like I’m Bernie Madoff in the back room while the cops are coming. Plus it’s a ton faster.

But as comedian Brian Regan says, “Both favorites!”

I love my shredder, too! It’s kind of an unnatural love affair, but we work it out — I feed him, and he satisfies my need to quickly rid my mailbox of incriminating evidence…I mean junk mail. Yeah, junk mail…

This post was a great reminder to me. I need to spend some time shredding my documents and backing up everything. One thing I really would like to do is have all my documents backed up electronically on an external hard drive. It would be pretty time-consuming (considering the fact I haven’t even gotten around to organizing the documents on my laptop…) but I think it would be worth it.

The one I really need to do is the shredding – I am not sure why do I find it so hard. And I remember 9/11 vividly – my son was five months old and watching the TV screen in the office I felt sad about his future. And the world did change but we have not learned much!

Thanks for including Credit Karma! We were so excited when we started offering free credit monitoring for this very reason–it can help you catch a new, unauthorized account FAST. Following your blog now!

This is why I like electronic statements. I don’t like keeping paper trail unless I have no other options. I think identity thieves have blossomed in the social media world; it has become increasingly easy for them to know a lot about your identity these days.

Wow, how incidental! I would not have expected the connection Identity thieves are just so horrible, and one of the biggest problems when you’re affected is proving you are who you say you are. That can be even more frustrating than the hassle of cleaning up someone else’s mess.

I’m fairly good at all but the back up. I’m storing all new docs. on drop box, but the old stuff needs to be backed up!!!!