Image Source: 123rf.com

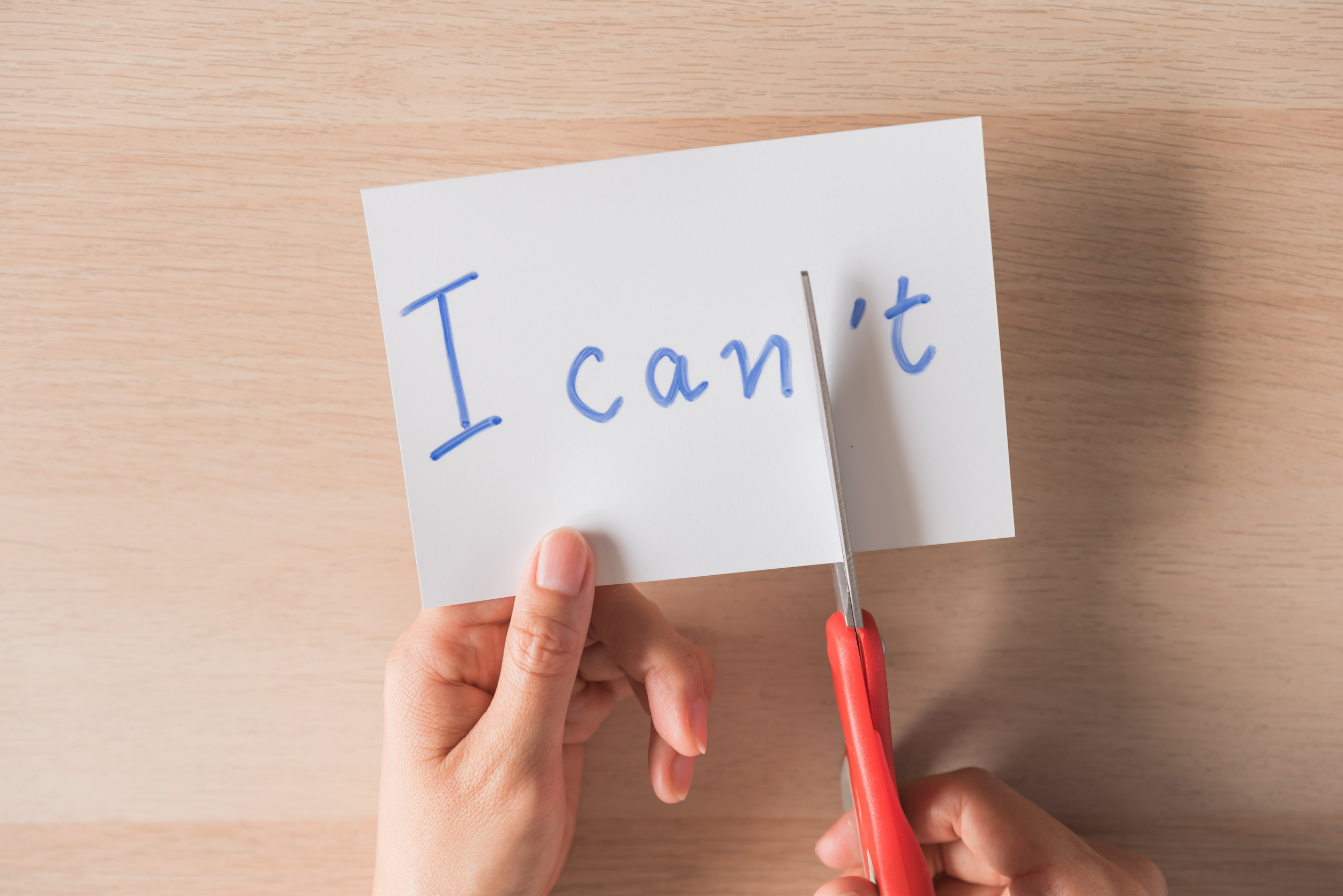

Debt isn’t always about making too little money or unexpected emergencies. It can also be deeply tied to psychology and self-worth. If you constantly feel like you’re not good enough, you may try to compensate by overspending and making financial decisions based on appearances rather than long-term security. An inferiority complex can quietly sabotage your finances, trapping you in a cycle of debt you don’t even realize you’re fueling. Here are six ways your self-doubt and low self-esteem may be keeping you in financial trouble.

1. You Spend to Impress Others

If you feel like you’re not as successful, attractive, or accomplished as those around you, you might turn to spending as a way to impress others. Whether it’s designer clothes, luxury cars, or expensive vacations, people with an inferiority complex often spend beyond their means to project an image of success. The problem is that this type of spending is fueled by insecurity, not necessity. Instead of building wealth, you end up financing a lifestyle you can’t actually afford. The result? More debt, more stress, and no real sense of financial stability.

2. You Avoid Talking About Money

People with an inferiority complex often struggle with asking for help or admitting they don’t know something—especially when it comes to money. If you avoid budgeting, negotiating salaries, or discussing financial concerns with a partner, you’re likely making financial mistakes that could be avoided. Ignoring debt or avoiding hard financial conversations doesn’t make the problem go away—it makes it worse. Facing your finances head-on, even if it’s uncomfortable, is the first step to breaking free from financial struggles.

3. You Rely on Debt to Feel Secure

If deep down you don’t feel capable or worthy of financial success, you might unknowingly sabotage your ability to save. Many people with an inferiority complex rely on credit cards, personal loans, or payday advances as a safety net, rather than building real savings. Instead of working toward financial independence, they create a false sense of security with borrowed money. The longer this continues, the harder it becomes to break the cycle, leading to chronic debt and financial anxiety.

4. You’re Afraid to Say No

Image Source: 123rf.com

Many people who struggle with self-worth hate disappointing others, which often leads to overspending on friends and family. Whether it’s covering group dinners, buying expensive gifts, or saying yes to things they can’t afford, their desire to please others comes at a financial cost. This fear of rejection or disapproval leads to unnecessary financial strain, making it harder to pay off debt or save money. Learning to set boundaries is crucial—saying no to overspending is saying yes to your financial future.

5. You Stay in Low-Paying Jobs

If you believe you don’t deserve better opportunities, you might stay in underpaid jobs or refuse to negotiate your salary. People with an inferiority complex often undervalue their skills and accept less than they’re worth, leading to years of financial struggle. The fear of rejection, failure, or being exposed as not good enough stops them from seeking promotions, switching careers, or asking for raises. Over time, this keeps them financially stuck, making it nearly impossible to get ahead.

6. You Use Shopping as an Emotional Escape

Retail therapy is real, and for people with low self-esteem, spending money can temporarily relieve feelings of worthlessness. Buying something expensive or trendy can create a brief moment of confidence—but that feeling quickly fades, leaving behind more debt and more insecurity. The cycle repeats itself, and over time, shopping becomes a way to numb deeper emotional struggles. Recognizing why you spend is the first step toward breaking the habit and building a healthier relationship with money.

Break the Cycle and Take Control of Your Finances

Your financial situation is deeply connected to how you see yourself, and an inferiority complex can quietly keep you trapped in debt without you realizing it. The good news? Self-awareness is the first step to change. Start setting boundaries, valuing your worth, and making decisions based on long-term financial health rather than insecurity. Money is a tool, not a way to measure self-worth.

Has your inferiority complex caused you to make bad financial decisions? What are you doing differently now? Let us know in the comments below.

Read More:

6 Subtle Financial Manipulation Tactics Narcissists Use in Relationships

13 Signs You’re Harboring A Victim Mentality That’s Keeping You Down

Tamila McDonald is a U.S. Army veteran with 20 years of service, including five years as a military financial advisor. After retiring from the Army, she spent eight years as an AFCPE-certified personal financial advisor for wounded warriors and their families. Now she writes about personal finance and benefits programs for numerous financial websites.

Leave a Reply