1. Open Communication

2. Fair, Not Always Equal

3. Use of Trusts

4. Specific Bequests

5. Life Insurance Policies

6. Staggered Distributions

7. Consider Spousal Access

8. Guardianship Clauses

9. Include All Children

10. Update Regularly

11. Seek Professional Help

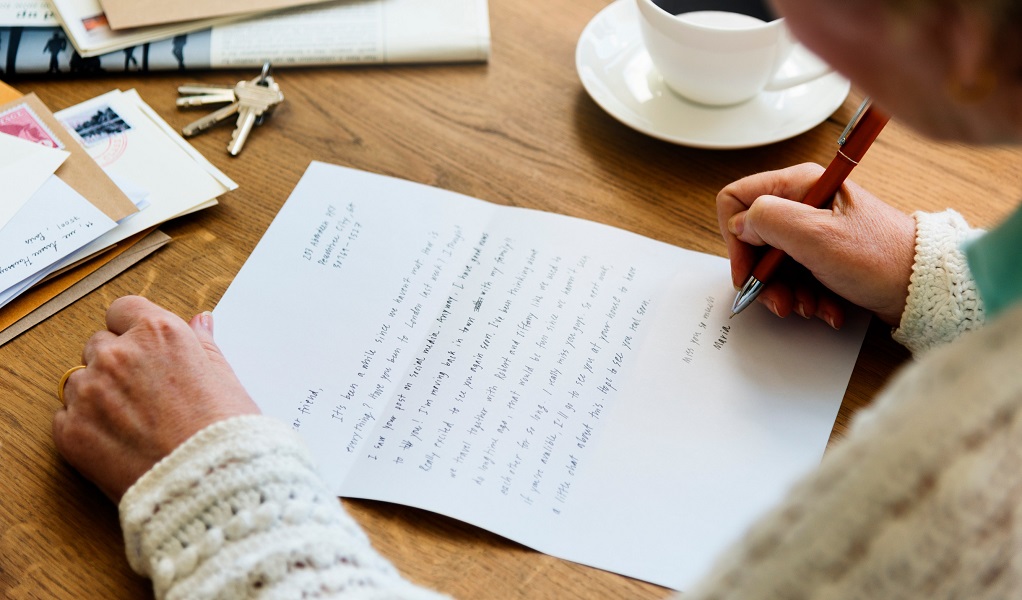

12. Personal Letters

Planning for Peace of Mind

The Basics of Estate Planning: A Comprehensive Guide

10 Genius Wealth Transfer Hacks That’ll Make Your Heirs Thank You Forever

Toi Williams began her writing career in 2003 as a copywriter and editor and has authored hundreds of articles on numerous topics for a wide variety of companies. During her professional experience in the fields of Finance, Real Estate, and Law, she has obtained a broad understanding of these industries and brings this knowledge to her work as a writer.

Leave a Reply