**Today is Cheryl’s birthday so I’m taking the day off to spend with my sweetie and theOtherGuy is in the driver’s seat. Take it away OG!

“No, thanks, nothing for me.”

How many times have you said that when being offered the double-chocolate-ice cream-sundae-float-combo dessert at your favorite restaurant? It’s almost a foregone conclusion, nearly as automatic as the “I’m just looking” comments we all say when shopping at the mall. But, how many times do we say that when we’re with our friends? It’s very easy to say “No, thanks” when we’re with strangers – but what about peer pressure?

In my practice, most of the money problems I help clients deal with stem from their inability to utter a simple two-letter word – “No.”. Some people have a hard time saying to their kids (“but I REALLY NEED that new video game…”) others have a hard time saying it to their friends. Still others simply just can’t say it to themselves. You want to excel at your financial life? Practice saying “No” as many times as you can each day.

I see so many missed opportunities in business that I also practice sales and marketing training for a well-known speaker and life coach’s firm. One of the primary ways we help people uncover more committed and focused time to growing their sales and their organizations is by saying “No” to as many non-critical things as possible. If you’re struggling or juggling with too many things – try saying “No.” there, too.

Financial success in the long-run is all about saying “No” to things today, in exchange for a greater future later. Here are a couple ideas to gain some “No” traction in your life:

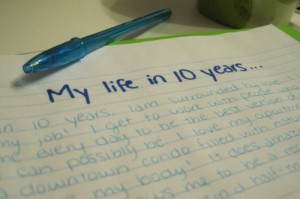

1) Write out your financial plan of attack – and stick to it. The human mind can’t tell the difference between vivid imagination and reality, so writing out your financial life can physiologically help you succeed. Most important to our discussion today, if something isn’t part of your plan, it provides a written backbone from which you can just say “No.”

2) Have a casual money conversation before it’s awkward. Clue your friends and family into the fact that you’re serious about making changes with your money. You can say things like, “It’s sure going to be different this year at Christmas time. We’re finally focusing on getting our financial house in order and we’ve promised each other we’re not going to overspend like we usually do.” In all likelihood you’ll be your friend’s hero. They only wish they had your fortitude.

3) Lead by example in your household. When you’re struggling with a purchase that you really, really, want, speak your mind out loud. Your kids will hear, see, and hopefully emulate your behavior. You can flip through a Best Buy ad and say things like “Boy, I sure like that new TV. It sure is sharp! One day, I’ll save enough money and then we can get that TV for our house, wouldn’t that be great?” Kids need to hear how you handle the day-to-day issues that come up, not just see how you handle them. Think out loud.

4) Pick someone else to blame. Use us. Use Dave Ramsey. Use Suze Orman. We shift blame our whole lives (trust me, I just saw my 3-yr-old blame the cat for coloring on the wall…with a marker. Everyone knows cats can use markers!) so shift blame to our site. Say “Hey, I’d really like to join you guys for drinks and dinner tonight, but OG and Joe say that’s a bad use of my money. I’m dumping it like crazy into my Roth IRA. A tax-free steak and bottle of wine tastes a lot better than one at 19.99% interest amortized over 15 years.” OK, that last part was a little over-the-top, but you get the idea.

It’s OK to say “No.” Trust me and try it out. Where and how can you say “No” today? Let us “No” below in the comments…(get it? No = know! Ha! I’m hysterical! Gettin’ crazy with the homophones.)