Impossible? You can do that…but you can’t keep doing the same thing you’ve been doing.

I was talking to my friend Tony last week. “I can’t seem to get ahead,” he said. Every time something good happens, something bad comes along to knock me back down.

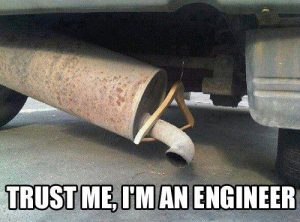

I remember this feeling. When I spent an entire year with little income, it seemed like every time I did something good, like get a credit card below the maximum, my muffler would be dragging behind my car.

How did I get ahead? How did I counsel my clients in this situation to get ahead? Put away the firehose.

When the fires from debt collectors are all around you, it’s easy to panic. They make good arguments. You read well-meaning pieces telling you how your credit is gonna be screwed for at least seven years if you don’t pay this bill NOW. Even though you’re avoiding the phone, you still see the caller I.D. You know exactly who’s calling, and the pit in your stomach grows bigger and bigger.

One night I came to a realization. I couldn’t sleep, so I’d grabbed a beer and a movie and was sitting staring at the screen. It hit me.

I was screwed anyway, so why was I sitting awake, worried about debt collectors? I’d never kill the fire unless I started walking toward the actual furnace.

That day I forgot about the debt collectors. I actually laughed at one guy when he threatened me. Do you know how empowering that is? At the time, I think he thought I was some deadbeat nutjob. But once I realized that he couldn’t hurt me, I became stronger.

My New Debt Payment Plan:

1) We set up automatic savings. From then onward, whenever money came in ¾ went to debt and ¼ went to build a reserve.

2) I scheduled financial meetings with Cheryl so we were on the same page (at the time she paid the bills and I took care of the debt repayment people…for the first time we were doing it all together).

3) Instead of solving every fire by throwing cash at it, we started to get creative. Our weekends were spent going to garage sales for school clothes for the kids. Pot luck game nights at our house became a boon (people would all bring over food and nobody would take it home…we’d eat other people’s leftovers for a good part of the week).

4) When things broke I learned to fix them myself. I’m an oil change and vacuum cleaner repair expert.

5) I began bringing work home to cut down on daycare bills. Sure, it took me longer to get stuff done with twin five year olds running around, but I adopted the motto that I can “sleep when I’m dead.”

Every dollar we came in under our original “budget” went to debt. It didn’t matter that our budget wasn’t balancing. I could starve a little today. I didn’t want to live this way forever.

I can definitively point to that day as the time when things turned around for me. Did things get better right away? Ha! Of course not! They got worse, as you would expect. The second I put down the fire hose, we were consumed by the little brush fires. But I was finally moving toward the actual furnace, and was able to turn the tide much faster than if I’d just kept trying to handle all the little problems.

Photo: Official U.S. Navy Imagery

Although I’ve never been in a position of debt collectors calling me, I do feel the pain of getting ahead, only to have some emergency come up. I’m still close to still living like that, although I’ve moved in a positive direction for quite awhile now, that emergencies don’t frazzle me as much as they used to. That said, I’m still not feeling as “ahead” as I want to, but that involves either living in a cheaper place, or earning more. But I agree worry does nothing. You just have to take action.

I like #3, as a student I would invite 8 friends over for dinner and then have dinner at their homes for the rest of the week. Cheap, social and fun!

Potlucks are one of those perfect techniques. People are grateful that you’re hosting so they don’t have to clean their house. 30 minutes of cleaning before/after and you can save hours of cooking time. Have some serving dishes out to “save space” and people will feel strange scooping stuff back into their crock-pots.

These are all great tips Joe. “Being creative” is the one that I am constantly doing. How can we save on this bill? How can we stretch this meal? Is there something we own that we can use instead of puchasing something brand new? Always keep thinking outside the realm and keep pushing forward!

Early in my career, I remember keeping a company afloat by just communicating with our vendors. The company was undercapitalized and spent more than they earned. Not that different from an individual! Two of the executives drove a Ferrari and Maserati, I became super creative with cash flow until we could sell the company. The executives would never give up the cars.

When I was in college , I learned how to stretch my summer earnings to survive on a budget. It was the best lesson, I ever learned.

okay, so the exhaust pipe attached with a coat hanger, Mr. PoP totally did that with my first car. Though it was a wire coat hanger that he bent out of shape and wrapped to keep it held up. =) Ahh, sweet memories of the days when we were that poor!

Great steps. I like how you didn’t let the bill collector bully you. We learned how to fix things ourselves as well. Youtube is a plethora of knowledge and how to videos.

Love the pointers in this blog. If you have the banks calling you because of not making your mortgage payment, look into a Federally sponsored loan modification program. If your house is underwater (not literally, but worth less than you owe), you may qualify for a loan that will adjust your loan amount. A little footwork and effort could save thousands in mortgage costs and prevent a foreclosure.

The automatic savings works really great. Once it’s set up you don’t even have to think about it. I bet building that reserve boosted your morale big time.