I did away with my Boner of the Week! series that called out stupidity in financial media and blogs because I didn’t want to be that guy. Well, at least not be that guy not every week.

But this site is called the Free Financial Advisor for a reason. My task is to show people the difference between the truth and lunacy; to dole out useful tips that you can apply, sprinkled with my own quirky sense of humor.

Buy the doughnut, the frosting comes free. Bargain!

What I also drag along is a HUGE sense of anger when I see absolute baloney (polite terminology) on the internets.

I fought it as an advisor, and I’ll fight it here for you.

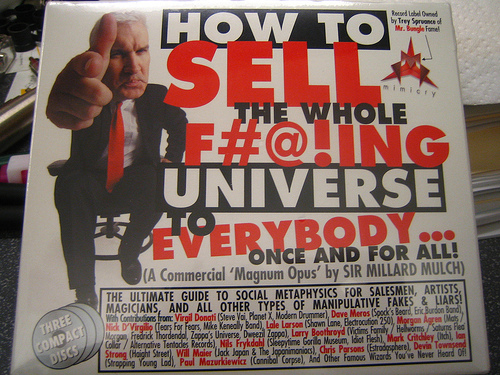

So, this week I’m going to un-bury the Boner of the Week! segment, along with the prerequisite, er, uncomfortable picture. Because I’m too lazy to find a new one, you’re treated to my favorite from the old series.

You’re welcome.

Let’s rant:

A Tip For New Investors:

If someone shows off a chart with a couple squiggly lines and points at them BUT REFUSES TO TELL YOU WHAT THEY MEAN it isn’t “analysis.”

It’s smoke and mirrors.

That’s why I like the DQYDJ blog and ws fired up when PK agreed to join our little podcast. He presents a chart or concept and then explains it. I’m a little smarter for visiting DQYDJ. Check out How Do You Know You’re Ready For Active Investing? Sure, I get PK’s returns, but I also get books to read, a chart on his personal progress and the story of how he began. Good story, good tips, good times.

Onboard?

Don’t try to just show me a chart and tell me “I predicted the financial markets would decline, and see, I’m right.” No reference to how the chart works. No rationale behind the prediction. Just “I’m right. Deal with it.”

Even if the chart is flippin’ brilliant, do you treat financial sites like the circus? Do you come here to see my dogs and ponies? My smoke AND mirrors? Do you want me to flash you a quick glimpse of my 12 inch wealth of knowledge so you can swoon over it?

Hell, no!

Like you, I visit sites for tips and tricks THAT I CAN USE. I don’t want to be shown stuff that I don’t understand.

If you hand me a shovel and I don’t know how to dig, all you gave me was a stick with a funny metal end.

Our “Boner of the Week!” target post (which I no longer point to directly, because that’s not the point of the piece….the point is to help you make better, more informed decisions. If you visited this bloggers site this week, I’ll apologize on his behalf), told us this week that “Mr. Brilliant” called the exact day the market was going to decline. He then advised us to stay out of stocks because it’s a bad, bad time for the market which will correct to (AND THEN HE BESTOWED UPON US THE EXACT RANGE!!!!).

Someone alert Jim Cramer. There’s a new sheriff in town.

Why the hell isn’t this guy working for a huge Wall Street firm or being paid the big bucks by wealthy investors who eat these gurus up? I used to ask my clients this question when they’d bring in what I’d call “miracle fliers” from their mailbox. Some dude telling them that he has all the answers.

I was a good financial advisor. I knew one thing: I didn’t have all the answers. Ta-Da!!!

Oh, my friends, that alone wouldn’t raise my ire. Ready for the next one?

Then he tells us to subscribe so we can find out what stocks we should buy when the time is right.

Thank you, your lordship Mr. Merlin soothsayer.

I don’t want a magical list of stocks. IF I did, I wouldn’t be looking for them on your free internet site.

Here’s what I want: tell me the criteria you used and I want to be taught to use it.

What I’m Railing Against

Did the dude call the market?

Yup. It appears he did.

Could he know how market conditions work?

Yup, he maybe can.

Are you just whining, Joe?

No.

I want this dude to tell me why, not what! A site like this is dangerous because you become dependent on the author. What happens if Mr. Brilliant has a Philly cheesesteak sandwich that doesn’t agree with him tomorrow and his indigestion decides that you should go 100 percent into Zynga stock? Or he tells you that the end of the world is coming and you should sell everything? Would you just follow like a lemming off the cliff?

- Don’t follow someone blindly.

- Learn to do your homework.

I naturally mistrust when ANYONE tells me they can call the market (after 16 years as a financial pro I saw professional gurus get beaten down by the financial markets time and time again).

One of my favorite stock trading books is called Trading Rules: Strategies for Success’ target=_blank>Trading Rules, by William F. Eng. The basic tenant of the book is that you do yourself a huge favor when you quit pretending you know anything about the financial markets. Once you realize that it’s a freakin’ scary-ass place, you’ll start protecting yourself and making money.

One of Mr. Eng’s fundamental rules: Tips Don’t Make You Money (Rule 7).

William F. Eng is a wealthy trader. I understand his background. I know nothing about wonderboy Mr. “I called it” dude.

Set stop losses. Learn how fundamental analysis works. Explore technical analysis.

But don’t let someone tell you when it’s the time to buy and the time to sell JUST BECAUSE THEY TOLD YOU SO!

They won’t lose the money, you will. And then you’ll be cursing the blogger, who won’t hear you over the dance music he’s playing for the rest of the suckers who hang on every word he says.

Rant over.

I might have read this post you’re referring to. As I’m not heavily into investing at this point with my finances, I don’t pay things like this much mind. But anyone that can predict the market is lucky. There’s no way you’ll be right every single time. Unless you have a crystal ball, there’s no way of knowing for sure. And if you have a crystal ball, I wouldn’t blog about what’s going to happen. I’d stick all my liquid assets into the best stocks and keep my mouth shut so there wasn’t a flood of investing that diminished my own stock’s value.

Like I said, though, I have very little idea what I’m talking about.

Oh, you know more than you think, FF. What’s that line about “the more we know the less we know…”?

Great point about not following someone just for the sake of following. It’s important to do your own research and understand the whys behind every decision in life.

BTW, where is that awesome deal with free frosting on the donut? I always get the frosting surcharge at my local bakery…

I think somebody’s gettin’ ripped off, Christa! 😉

I was very pleased to find this site. I wanted to thank you for this great read!! I definitely enjoying every little bit of it and I have you bookmarked to check out new stuff you post. Big thanks for the useful info……..

Excellent. I don’t really invest yet, but your logic is tight. I say the same thing to family members when they’re going to get their car fixed, oil changed, bath remodeled, etc. Ask them WHY they’re doing what they’re doing, WHY they have a certain cost, WHAT these things mean… don’t just go “Oh you say so, so go ahead and do it.” As a blue collar guy, I get upset when people get ripped off by other blue collar guys, but at the same time, I have to blame people for getting ripped off sometimes… ASK QUESTIONS! UNDERSTAND THE “WHY”!! Walk away and look it up yourself to see if it’s legit!

Yes! I know zippo about cars TB, but every time I have my car in for service, I’m a little annoying with the guy. I have no intention of fixing cars myself, but I need to know the basics so that I can better understand what I’m paying for.

This is priceless stuff, Joe. When I see “A tip for new investors,” I read “A tip for Michelle and Jefferson!” 🙂 We are so green here…it’s a good thing we have friends who know wth they’re talking about with investments!!

You’re in the right field, Michelle! By blogging, you’re surrounded by money geeks all day. We aren’t that scary. 😉

So true. I have no financial background so when I look at a chart I literally see a line going up: something good happened. Line going down: Sell! Sell! For someone like me, I need the rationale explained to even wrap my head around the conversation.

Good points Joe, and thanks for the link. A picture may be worth 1000 words, but that doesn’t mean I’m going to remove 1,000 words of my article just because I’ve got an image.

What do you think about my “use options to predict the future” math and charts? Too wonky and esoteric? (Seriously, you’re in the inner circle so if you want a demo of how I do it let me know some day, haha)

I’m fascinated by the charts, PK. I would have thought that they’d be a better predictor of the future than they’ve been. At first I thought this meant that using options ot predict stock market action is foolish. Then I realized there might be a different story altogether in these tea leaves…maybe the random walk down wall street truly is pretty random, since it’s prognoticators who’re driving option pricing…and they don’t seem to have a clue. BTW, that’s more reason why I’m convinced this article above is so dangerous for investors. If the people buying/selling contracts (almost completely pros) can’t figure out the market, how can he?

You’ve got to keep this series going. It’s pretty good! I think I may have also read the post you are referring to. Like you said – why is he wasting his time with a post and not working for the largest hedge fund on Wall Street?