Student loan debt is a significant financial challenge for millions of graduates. With the rising cost of education, more students are relying on loans to fund their college degrees, resulting in substantial debt upon graduation. This financial burden can impact various aspects of life, including the ability to save for retirement, purchase a home, or even pursue further education. The weight of student loans can also cause stress and anxiety, making it essential to find effective ways to manage and reduce this debt.

Student loan debt is a significant financial challenge for millions of graduates. With the rising cost of education, more students are relying on loans to fund their college degrees, resulting in substantial debt upon graduation. This financial burden can impact various aspects of life, including the ability to save for retirement, purchase a home, or even pursue further education. The weight of student loans can also cause stress and anxiety, making it essential to find effective ways to manage and reduce this debt.

While the prospect of repaying student loans may seem daunting, there are numerous strategies available to make the process more manageable. By understanding the details of your loans, exploring different repayment plans, and taking advantage of various financial tools and resources, you can create a realistic plan to tackle your student debt. Here are six effective ways to manage student loan debt and work towards financial stability, ensuring that your loans do not hinder your long-term financial goals.

1. Understand Your Loans

The first step to manage student loan debt is to thoroughly understand the details of your loans. This includes knowing the types of loans you have (federal or private), the interest rates, repayment terms, and the total amount owed. By keeping track of these details, you can make informed decisions about repayment strategies and prioritize which loans to pay off first. Use tools like the National Student Loan Data System (NSLDS) for federal loans or contact your loan servicer for private loans to get all the necessary information.

2. Explore Repayment Plans

Federal student loans offer various repayment plans designed to accommodate different financial situations. Income-driven repayment plans, such as Income-Based Repayment (IBR) and Pay As You Earn (PAYE), adjust your monthly payments based on your income and family size. These plans can lower your monthly payments, making them more affordable, especially during times of financial hardship. Research all available repayment options and choose the one that best fits your financial circumstances to ensure sustainable loan management.

3. Consider Refinancing

Refinancing your student loans can be an effective way to manage student loan debt, particularly if you have high-interest rates. By refinancing, you can consolidate multiple loans into one with a lower interest rate, potentially saving you money over the life of the loan. Private lenders offer refinancing options, but it’s important to compare rates and terms from different lenders to find the best deal. Keep in mind that refinancing federal loans into private loans means losing federal benefits, such as income-driven repayment plans and loan forgiveness programs.

4. Make Extra Payments

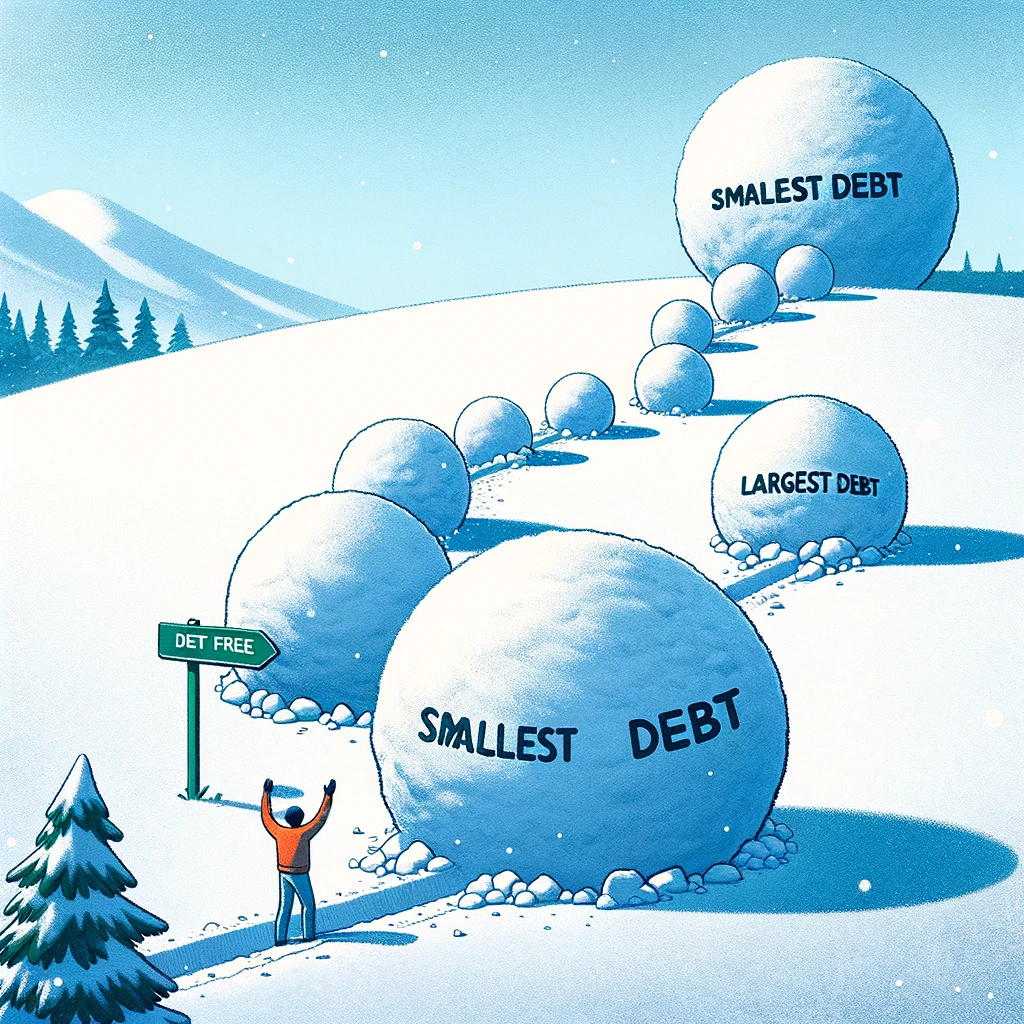

Whenever possible, make extra payments on your student loans to reduce the principal balance faster. This can significantly decrease the amount of interest you pay over time and help you pay off your loans sooner. To make extra payments effectively, ensure they are applied to the principal balance rather than future payments. Contact your loan servicer to specify that any additional payments should be directed towards the principal to maximize the impact on reducing your debt.

5. Utilize Employer Assistance Programs

Many employers offer student loan repayment assistance as part of their benefits package. These programs can provide direct payments towards your student loans, reducing your debt burden more quickly. Check with your employer to see if they offer any student loan repayment assistance. If available, take full advantage of these programs as they can significantly accelerate your repayment process and lessen the overall financial strain.

6. Seek Loan Forgiveness Programs

For those with federal student loans, various loan forgiveness programs can provide relief after a certain period of qualifying payments. Programs such as Public Service Loan Forgiveness (PSLF) and Teacher Loan Forgiveness are designed for individuals in specific professions. To qualify for these programs, you must meet certain criteria, including working in a qualifying public service job and making consistent payments under an eligible repayment plan. Research the requirements and apply if you believe you are eligible, as loan forgiveness can alleviate a substantial portion of your debt.

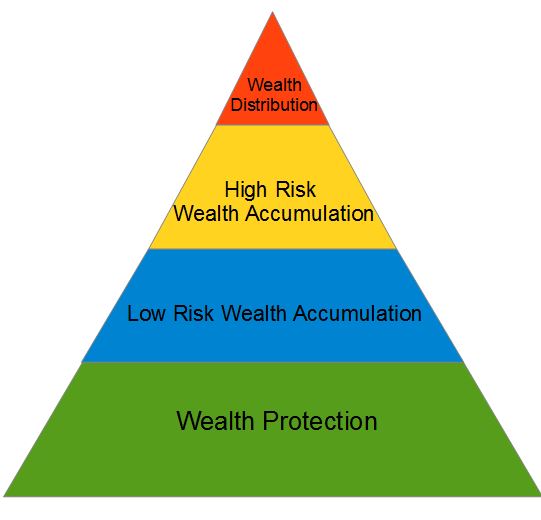

Taking Control of Your Financial Future

Having to manage student loan debt may seem daunting, but with the right strategies, you can take control of your financial future. By understanding your loans, exploring repayment plans, considering refinancing, making extra payments, utilizing employer assistance programs, and seeking loan forgiveness, you can significantly reduce your debt burden. Proactive management and informed decisions are key to achieving financial stability and freedom from student loan debt. Start implementing these strategies today to pave the way for a more secure and financially independent future.

Toi Williams began her writing career in 2003 as a copywriter and editor and has authored hundreds of articles on numerous topics for a wide variety of companies. During her professional experience in the fields of Finance, Real Estate, and Law, she has obtained a broad understanding of these industries and brings this knowledge to her work as a writer.