Money management isn’t easy, and it’s hardly taught in schools. Wise allocation and utility of resources can make a rich man out of a meager income. It can even turn something like debt into a “good” thing.

Student debt is often characterized as “good” debt, because if appropriately pursued, it can lead to gainful employment. It can also lead to a lifelong expense perpetually hanging over your head; so be careful to study something that will actually get you employed down the line.

Bad debt would be something like credit card debt, or that which usually develops from getting stuck in a payday loan cycle. This debt drags you down, is usually unnecessary, and can be disastrous to your personal autonomy in terms of finances.

It can be hard to get out of debt if you’ve made a few money management mistakes in your life. But there are techniques, strategies, refinancing options, and consolidation solutions available; you’ve just got to seek them out.

Ways To Overcome Debt

Seek out extensive, experienced, and insightful debt-liberation advice from professionals, such as those at Debt Academy for example. Using services available through agencies like this can provide you information about debt that you likely wouldn’t find on your own. You can get solid advice that helps you make your next step. For example: what kind of expenses can you cut from your regular budget to help pay off existing debts more quickly?

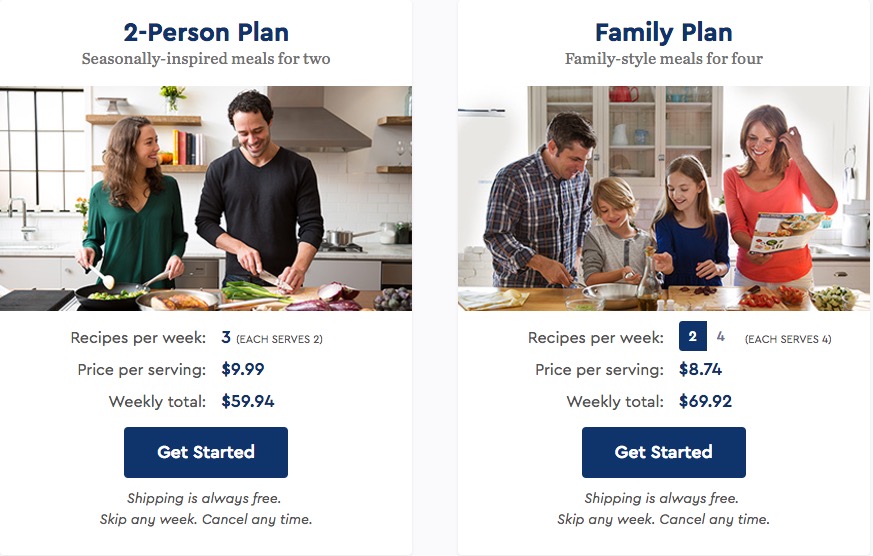

Do you eat fast food, or have a penchant for pricey coffee? Cut that out. If you buy one $5 Starbucks coffee a day, that’s $35 a week, and $140 a month. In a year, you’ve spent $1,680 on coffee. Meanwhile, you’ve got a $200 a month car payment. Between the two, you’re spending $4,800 annually you don’t need to.

Sell the car and turn that money into a more cost-effective used vehicle. If you can recoup $5k from your car, then you can go on Craigslist.com and find a very good vehicle that will last you at least five years if you take care of it. Now you’re saving $4,800 a year that you can use to pay off debt.

Sustainable Energy And Mortgage Sale

Depending on your situation, you may sell your property. If you’re in debt, but have a good piece of property and the ability to spend several thousands before selling, you could increase the money you make in the sale. Firstly, you’ll want to find an organization that can sell a mortgage note.

Once you know who can help you sell your property, it’s time to upgrade it. A $5k investment in solar energy can get you a $5.1 kWh solar energy system which will increase property value between $15k and $20k depending on the state you live in. You may also get a tax break, but collecting on that will depend on when you sell the house.

With the money you make from selling the home, you can pay off your debts and downsize until you can afford a larger property once again.

Everyone’s situation will be different, but one thing is sure: by getting rid of certain lifestyle costs, you can free up resources and transcend debt more quickly.