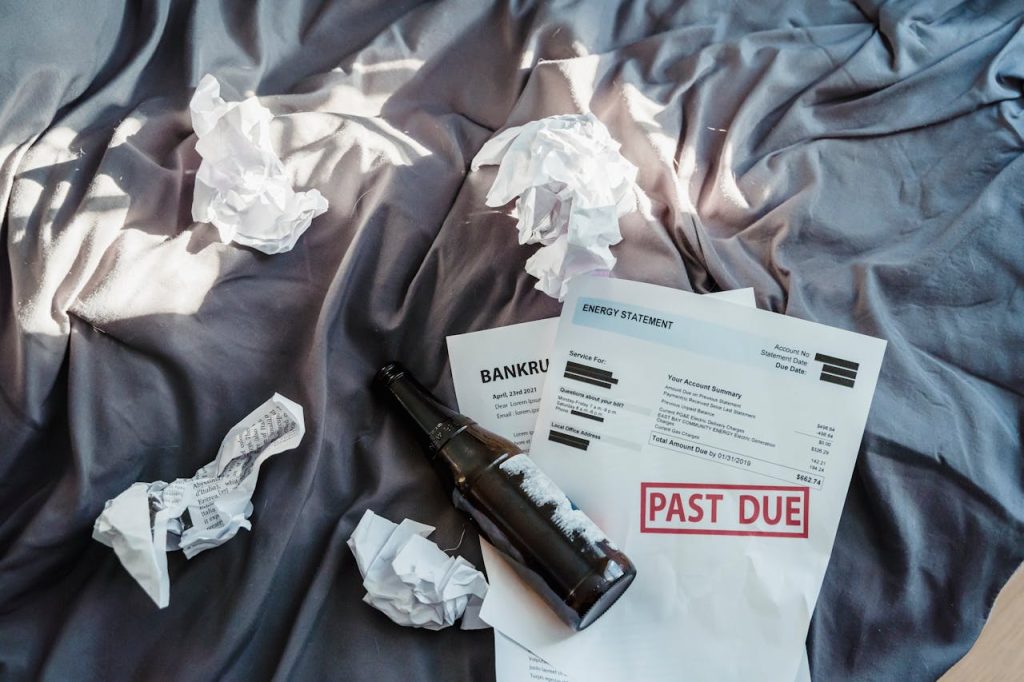

Image source: 123rf.com

You can spend years saving, budgeting, and investing carefully, only to watch your efforts unravel because of personal relationships. Money is deeply tied to family life, and emotions often complicate otherwise sound strategies. When disagreements, expectations, or pressure come into play, the strongest financial plans can quickly fall apart. Understanding how family dynamics ruin financial plans helps you prepare for challenges that numbers alone can’t solve. With awareness and communication, families can protect both their wealth and their relationships.

1. Conflicts Over Inheritance

One of the most common ways family dynamics ruin financial plans is through disputes over inheritance. Even when a will or trust is in place, disagreements between siblings or relatives can create costly legal battles. These conflicts often drain resources meant to provide stability for the next generation. In some cases, family members fight over sentimental items just as fiercely as large sums of money. Without clear communication and planning, inheritances that were supposed to provide security often turn into sources of division.

2. Supporting Adult Children Financially

Parents often feel compelled to provide ongoing financial help to adult children. While the intention is loving, it’s another example of how family dynamics ruin financial plans. Continued support—such as paying rent, covering debts, or financing lifestyles—can drain retirement savings and derail long-term goals. Families who don’t set boundaries may find themselves sacrificing their own security. This hidden pressure can leave parents vulnerable later in life when they need funds the most.

3. Disagreements Between Spouses

Even the most carefully built budget can collapse when spouses are not aligned on money goals. Differing views on spending, saving, or investing often lead to tension and overspending. Over time, these disagreements can result in missed opportunities and financial setbacks. Many couples underestimate how much their personal habits and communication impact long-term planning. Spousal conflicts are a clear example of how family dynamics ruin financial plans if not addressed early.

4. Caring for Aging Parents

Family responsibilities don’t only flow toward children—aging parents often need support as well. Medical bills, assisted living, or unexpected expenses can put a huge strain on adult children’s finances. Without proper preparation, these responsibilities can drain emergency savings and retirement accounts. Families may also disagree on how to split caregiving and costs, adding more tension to the situation. This caregiving challenge shows another way family dynamics ruin financial plans unexpectedly.

5. Unequal Expectations Between Siblings

Siblings often assume financial responsibilities will be divided fairly, but reality doesn’t always match expectations. One sibling may contribute more to caring for parents or managing family assets, while others contribute little. Resentment builds, and arguments erupt over fairness and obligations. These disputes not only damage relationships but can also stall decision-making about shared assets or properties. Unequal expectations are a common way family dynamics ruin financial plans and prevent cooperation.

6. Divorce and Separation

Few events have as devastating an impact on financial stability as divorce. Assets are divided, legal fees mount, and retirement savings may take a significant hit. Even carefully crafted financial plans cannot withstand the sudden disruption of splitting households. The emotional toll also makes it harder to make sound decisions in the moment. Divorce serves as a stark example of how family dynamics ruin financial plans despite careful preparation.

7. Pressure to Maintain Appearances

Some families feel pressure to keep up with appearances, whether it’s hosting lavish holidays, paying for big weddings, or funding expensive vacations. These decisions are often more about family expectations than financial logic. Over time, this lifestyle creep drains savings and undermines long-term goals. Relatives may even guilt individuals into spending more than they can afford. Social pressure within families is yet another way family dynamics ruin financial plans silently.

Protecting Finances While Preserving Relationships

The reality is that family dynamics ruin financial plans when emotions override logic. But families can prepare by having open conversations, setting boundaries, and involving neutral professionals like financial planners or mediators. Strong plans include not just numbers but strategies for handling conflict, caregiving, and expectations. By balancing financial responsibility with compassion, families can protect both their wealth and their connections. After all, the goal of money is not just security but harmony across generations.

Have you seen family dynamics ruin financial plans in your own life or others’? How did you handle it? Share your experiences in the comments below!

What to Read Next…

Are State Heir Laws Disfavoring Blended Families in 2025?

9 Promises Adult Children Make to Their Parents, But Have No Idea of How to Keep Them

8 Unsettling Consequences of Refusing to Attend Family Gatherings

Why Do Advisors Downplay the Cost of Raising Children

12 Capital-Gains Surprises When You Sell the Family Home After 55

Catherine is a tech-savvy writer who has focused on the personal finance space for more than eight years. She has a Bachelor’s in Information Technology and enjoys showcasing how tech can simplify everyday personal finance tasks like budgeting, spending tracking, and planning for the future. Additionally, she’s explored the ins and outs of the world of side hustles and loves to share what she’s learned along the way. When she’s not working, you can find her relaxing at home in the Pacific Northwest with her two cats or enjoying a cup of coffee at her neighborhood cafe.