I recently discovered a the UK stock Playtech, so I looked it up at BigCharts.com (link). Imagine my surprise when I saw this:

Wow! So, is this a good company? Well, there are some issues I need to look at, especially since I’m in the US and this company is in the UK. First, I discussed in a post today over at Stacking Benjamins the importance of evaluating the macro conditions that exist around a stock….like the economy and how the sector’s performing as a group. Besides that, I also need to dig into the numbers and see how this stock would look in my portfolio.

Before I actually begin digging into this company, traded on the London Stock Exchange, I also need to evaluate something else: my experience with this stock is going to be different than that of a UK based investor. Why?

Because I’m investing dollars and not British pounds.

Trading dollars for this company makes my transaction a little more complicated. I could actually have a horrible return even though the stock performs well if the dollar falls in value against the British pound. Many investors who jump on international companies forget that this is an important part of success or failure over the short run when choosing international positions.

….so, let’s take a look.

The Dollar Is Strong

Let’s take a quick look at free site DollarstoPounds.com to measure how the dollar compares:

As you can see, the dollar has been strengthening. According to this interesting piece on TheStreet.com, it appears that any Fed move should make the dollar even stronger. That’s good news for international investments, and especially in this case for an investment in the UK if I’m an American investor.

The Company – A Profile

According to their website, Playtech is the world’s largest provider of online gaming solutions. They work with many different gaming companies, from big names like Sky and Titanbet to much smaller firms.

Because we already looked at gaming companies from a macro level in our Stacking Benjamins piece, let’s dive into the numbers.

Fundamental Analysis

Looking at the numbers is called “Fundamental Analysis” by investors. That means we’re going to research how the company makes money and evaluate just how sound things are financially. Just like you know more about a family by looking at their budget, cash flow and debt, we’ll get a better feel for how this company performs by looking at this data. Most probably, we’ll create a list of questions we should ask ourselves before we invest. I’m always surprised by my digging….it feels a little like financial CSI. Ha!

How To Look For Fundamental Data

If you’re just going to take a cursory look at a company (the scope of today’s article), many people like using Yahoo! Finance. I don’t. Why not? Because what I’m interested in are trends. I want to see revenues improving. I also want earnings to be improving, and I want to compare debt levels against prior years. These numbers will tell me a quick story about the company. I may not get the full story, but just a set of current data at Yahoo! doesn’t help me at all.

Instead, I went to my brokerage site, which happens to be TDAmeritrade. I also have an account at Scottrade. Let’s compare.

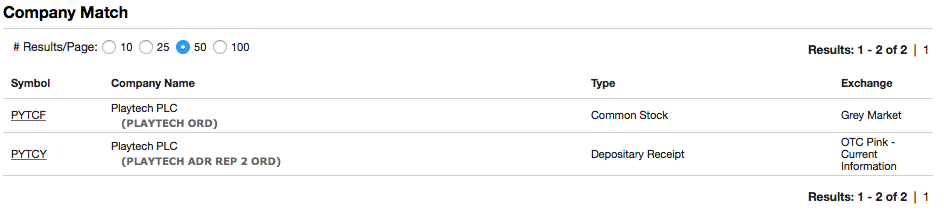

First, it’s difficult to make sure that you’ve got the right company when you’re looking at foreign investments. At TDAmeritrade, they show two different stocks:

Luckily, I know, these are actually two ways you can buy the same company. We’ll go into that another day…..but for now, I want to use the one that gives me the most data. Clicking the depositary receipt investment gives me no data. The other gives me what I’m looking for.

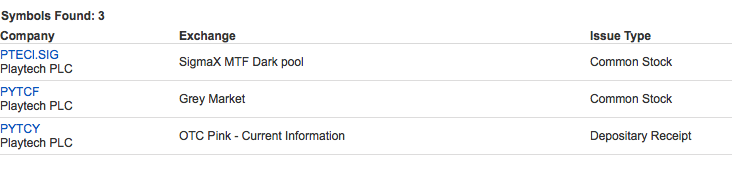

At Scottrade, when I ask for Playtech, it actually shows me three…..and I go with the Grey Market one (middle). It’s the same company.

At Scotttrade I also can look at prior year data…..I just prefer the graphs at TDAmeritrade that Scottrade omits.

So What Do We See? Good Stuff?

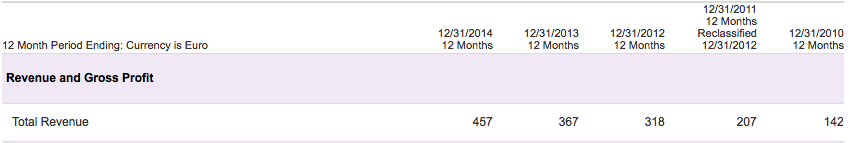

Revenues will show us if the company is making more money every year. We want a company that’s growing sales. Is that the case for Playtech?

You can see above, that revenues have grown year for the last four years. That’s good news.

In many cases your investigation will spur questions. In this case, it’s “if revenues are going up, are expenses staying in check?” We’ll need to find an answer to that before investing.

Earnings

One quick way to look at expenses is through the eyes of earnings. Revenues are “top line” numbers. It’s money coming in the front door. But if a company spends all that revenue and doesn’t make a profit, who cares? We don’t want more sales alone….we also want to see more money going to investors. We can monitor that through looking at earnings. If a company grows sales they might have acquired another company that had solid sales or they may have hired a ton more people. If earnings don’t rise also, we have a problem.

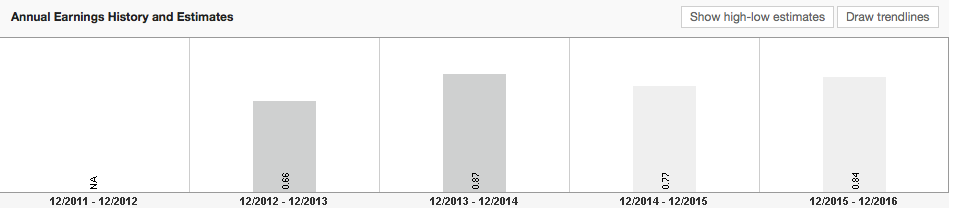

Let’s switch over to TDAmeritrade to look at earnings. Here it is:

As you can see, earnings are good so far, but next year they expect them to drop. That gives us MORE questions….why is the stock so hot if everyone expects the company to earn less in the future?

Debt

While I don’t see debt as a negative all the time, just like it can sink your personal financial situation, too much debt can sink a company. Let’s take a look:

Where did this new “long term debt” line item come from in Q4 of last year? The stock is up AND there’s new debt AND analysts expect earnings to drop? There’s clearly something going on.

…and So On….

We’re not nearly done, but can you see how we’re forming questions about the stock as we read the numbers? Sharon Lechter (co-author of Rich Dad Poor Dad) told me on our Stacking Benjamins podcast that numbers tell a story that you want to learn how to read. In this case, I go to the news on Playtech and find this: Playtech Enters Foreign Exchange Market. Investors clearly like the synergy that this might create, even though over the short term they think the company will have lower earnings and had to take on debt for the transaction.

So Do I Buy?

In this case, I’m going to hold. The inconsistent earnings growth and new acquisition frighten me. There’s too much up in the air about how successful Playtech can be marketing Forex trading to it’s online gambling clients. I don’t think they’ll fail….I just don’t know…..and that’s enough of a reason for me to look elsewhere.

Leave a Reply