Here’s a depressing recent headline. Today the Federal Reserve Bank of San Francisco released a report predicting that the financial markets are unlikely to be strong for the next…drum roll please…16 years!

Can this be accurate?

The report, titled “Boomer Retirement: Headwind for U.S. Equity Markets?” illustrates long-range, historical data which suggests that as the boomer generation moves into retirement, they’ll pull an increasing amount of money out of equity funds. This can only mean increased pressure on stocks for years to come.

This is classic ‘supply & demand’ economics at work here, folks.

Roughly 10,000 baby-boomers turn 60 EVERY DAY, a trend that will continue for the foreseeable future. As each of these 10,000 individuals leaves the workforce, they need money to spend in retirement. Where will their meals come from? That’s right. Their spending money will come, in part, from investment portfolios.

As the report points out “…to finance retirement, they are likely to sell off acquired assets, especially risky assets. A looming concern is that this massive sell-off might depress equity values.”

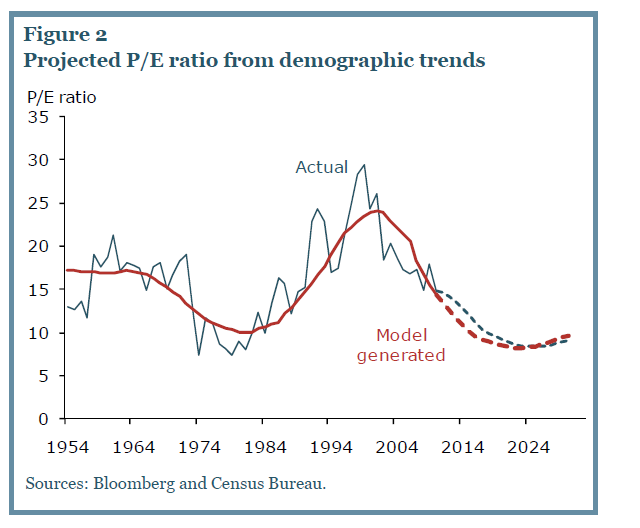

Take a look at this projection:

According to the research in this report, P/E ratios, an indicator of potential stock prices, is slated to continue downward through the early 2020s before rebounding in the latter half of that decade.

According to the research in this report, P/E ratios, an indicator of potential stock prices, is slated to continue downward through the early 2020s before rebounding in the latter half of that decade.

“Figure 2 shows that P/E should decline persistently from about 15 in 2010 to about 8.4 in 2025, before recovering to 9.14 in 2030.”

The report continues: “The model-generated path for real stock prices implied by demographic trends is quite bearish. Real stock prices follow a downward trend until 2021, cumulatively declining 13% relative to 2010…real stock prices are not expected to return to their 2010 levels until 2027.”

Ouch. That could sting a little.

So what does this data imply?

Should we all be in bonds until 2030? Quite the contrary. There will likely still be bullish trends throughout the upcoming cycle, so it pays to be vigilant.

Instead, I believe this heralds the end of “buy and hold and you’ll be fine” investing.

This mean you’ll need to be cognizant of market trends and invest accordingly. What does your advisor think about this report? In all likelihood, he’s never heard of it, and will probably say something like “Just invest and stick with the plan, and you’ll be OK.”

You can do better. If you just pay attention to the signs, you can profit from both sides of the market, both the ups and downs. You just have to pay attention.

If you’d like to read this report for yourself, it’s available here or type in http://www.frbsf.org/publications/economics/letter/2011/el2011-26.html to read for yourself.

I’m interested in your thoughts…post your comments below.

Wow! That’s some scary data. This website is quickly becoming my go-to site for up to date information and ideas. Keep up the good work.