Nonprofit organizations often face confusion while deciding on the appropriate 990 forms for their organizations. When it comes to small nonprofits, the confusion intensifies as there is a subtle difference between the forms they are required to file, such as Form 990-N and Form 990-EZ. So, It’s important to understand the key differences between them.

In this blog, we aim to aid those small nonprofits by breaking down the key differences between Form 990-N and Form 990-EZ.

Understanding Form 990-N and 990-EZ

Form 990-N (e-Postcard) is an IRS tax form used by most small nonprofit and tax-exempt organizations to meet their tax obligations.

Form 990-EZ (Short Form Return of Organization Exempt from Income Tax) is a shortened version of the standard Form 990, designed to satisfy the annual filing requirements of small to mid-ranged organizations.

Form 990-N vs Form 990-EZ — A Comprehensive Breakdown

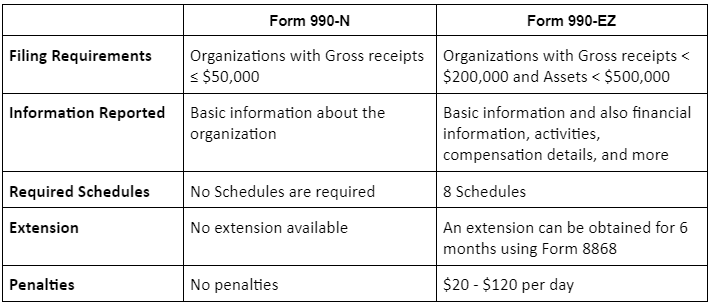

The purpose of both forms 990-N and 990-EZ might seem similar, but the distinction lies in the specific types of organizations that are required to file each form. Here are the key differences between the forms

- Eligibility Requirements

Form 990-N:

Small nonprofit organizations can file Form 990-N if their gross profit is generally equal to or less than $50,000. If,

- It has been in existence for 1 year or less and received or vowed $75,000 or less during its first tax year

- It has been in existence for 1 to 3 years and has an average gross receipt of $60,000 or less during its first two tax years.

- It has been in existence for 3 years and has an average gross receipt of $50,000 or less for the immediately preceding 3 tax years.

Form 990-EZ:

Nonprofit organizations can file Form 990-EZ if their gross receipt is less than $200,000 and total assets are less than $500,000 at the end of their tax year.

Organizations eligible to file Form 990-EZ include those that are

- Exempt from income tax under section 501(a)

- Political organizations under section 527

- Nonexempt charitable trusts

Note: Non-profit organizations eligible to file Form 990-N may optionally choose to file Forms 990-EZ or 990. Those required to file Form 990-EZ can file Form 990, but vice versa is not possible.

- Information Required

Form 990-N requires less information compared to Form 990-EZ. Form 990-N only requires basic information about the organization, whereas Form 990-EZ includes detailed financial data, activities, compensation specifics, and additional details.

- Schedules

Form 990-EZ filers have 8 different types of schedules based on requirements. In contrast, Form 990-N filers are not required to submit any additional filings.

- Penalties

Late filing of Form 990-EZ can result in penalties ranging from $20 to $120 for each day the return is late, depending on the organization’s size. Form 990-N typically does not carry any penalties for late filing.

- Extensions

The deadline for filing 990-EZ can be extended by using Form 8868. On the other hand, 990-N does not have any extensions.

A Quick Run-Down of the Key Differences

Similarities Between 990-N and 990-EZ

While we’ve discussed the major differences between 990-EZ and 990-N, here are some of the aspects that lie in common for both these forms.

- Deadlines

All 990 forms, including 990-N and 990-EZ, share a common deadline that is the 15th day of the 5th month following the end of their tax year.

- Automatic Revocation

Failure to file any of these forms for three consecutive years could lead to the automatic revocation of their tax-exempt status.

- E-file Mandate

Both Form 990-N and Form 990-EZ must be submitted only through electronic filing as mandated by the IRS. This can be accomplished by using an IRS-authorized e-file provider.

- Public Disclosure

Like every other 990 form, once Form 990-N and Form 990-EZ are approved, they will be made available for public review.

Conclusion

Understanding the key significance of both forms allows nonprofits to navigate their tax obligations efficiently, minimizing ambiguity. To streamline this daunting process, opting for an ideal e-file provider is advised, which could significantly reduce these obscurities and, in turn, lessen the administrative burdens.

Leave a Reply