Congratulations!

As we roll into July, you’re nearly half way through your 2012 goals.

How are you doing? If you’re a planner by nature, then you already know the answer to that question. Heck, you probably have a bar chart in your bedroom!

…you’re so romantic….

But, if you’re like the 90% of us who don’t actually keep day-to-day tabs on exactly how we’re doing relative to the things we said were important at the beginning of the year – this weekend’s a great time to reset the meter.

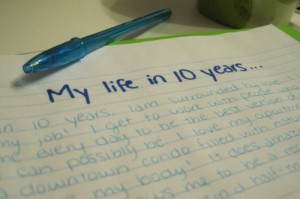

You probably started out 2012 with a list (check that: an idea) of what financial goals you’d like to accomplish. Items such as: pay off debt, build a cash reserve, save for a down payment, increase your retirement savings – important goals. But, did you actually capture it in writing? We’ve all heard it before – writing your goals down makes you more likely to hit them.

Let’s complete a little goal setting exercise to achieve the goals we set out to accomplish only six months ago.

Goal Setting In Five Easy Steps

Step 1: Make four columns on a piece of paper. Label them 1 year, 3 year, 10 year, and Lifetime. Now, for the next three minutes, think about all the things you want personally (toys, cars, houses, etc.) – we call these (“thing” goals) – and list each in the appropriate category. For example, if you want a Ferrari, but you’re thinking in the next 10 years, put “Ferrari” under the 10 year column.

After three minutes are up, spend another three minutes on money goals and another three minutes for spiritual / well-being goals. After nine minutes, you should have a list of all the 1, 3, 10, and Lifetime goals you could think of in the three areas of your life: things, money, and spiritual.

Step 2: Now, take 5 minutes to go through your columns, move things around and clean up your brain dump. Now your list should look a little more legible and it should be somewhat realistic.

Step 3: For our goal setting exercise, let’s take a look at all of your 1 and 3 year goals. Go through them and pick out one “thing” goal, one personal goal, and one money goal for each.

Step 4: You now have a total of 6 goals, three of which you’d like to accomplish in the next year. Never leave a goal setting session without taking action toward that goal. So, what you should do is make a list of the three to four action steps that must happen to make those goals a reality. Of those action steps – pick one that you will do TODAY to move forward.

Step 5: Here’s the final litmus test – you have to ask these questions:

1) Can I afford it? Meaning – can you do what’s necessary to make it happen? Can you actually do it?

2) Will you do it? Goals are nice, being able to accomplish them is nice…but if you won’t do what’s necessary…then what’s the point?

If you’ve gotten this far and you’ve found 3-6 goals that are reasonable you must take at least one little action step now. Don’t leave the goal planning table without taking at least one little step!

Do it now!

Congratulations. You’ve gone through a 30 minute goal planning session that will put you in position to reach your goals!

Great job!

How are your goals coming along? Let’s talk about our goals in the comments? Which ones are you on track for and where is your focus the second half of the year?

Photos: Woman writing: Risager; Life in 10 Yrs: lulumon athletica

I am posting tomorrow, so I do not want to give away my progress.

Aw, come on, KC! Give us the great scoop for once…

We’re doing fairly well with goals. Income is down a bit, but happiness is up so its a good trade off for now.

We’ve definitely made a lot of progress towards goals. I got bunt out and took some time away, which was planned by the way. Now, I’m recharged and ready to make a lot of headway.

I must go back and check on the goals I set up in January. They are probably on my blog somewhere

My goal of “actually make a dollar” from blog – check!

Sweet! Spend it on a lottery ticket MMD and make it a cool million.