Source

If you are a small business owner whose bank loan application just got rejected, don’t lose heart because you’ll eventually find a way to grow your business. Before you delve into the solution, look through various reasons why bank did not approve your application.

There are many reasons why banks are reluctant to lend to smaller businesses. These include:

- Unconvincing business plan – many new businesses lack a detailed business plan to support their loan application which gives the impression that you haven’t given your business idea proper thought and research.

- Little or no record of success – banks want to see a history of strong market position and financial statements which is something new or smaller businesses cannot offer.

- Lack of collateral – collateral acts as security on the loan and if you don’t have any, the bank has no assets to sell to recover the loan amount.

- Cash flow problems – due to limited revenues in comparison to costs, small businesses often have cash flow problems, so they’re likely to default on interest payments.

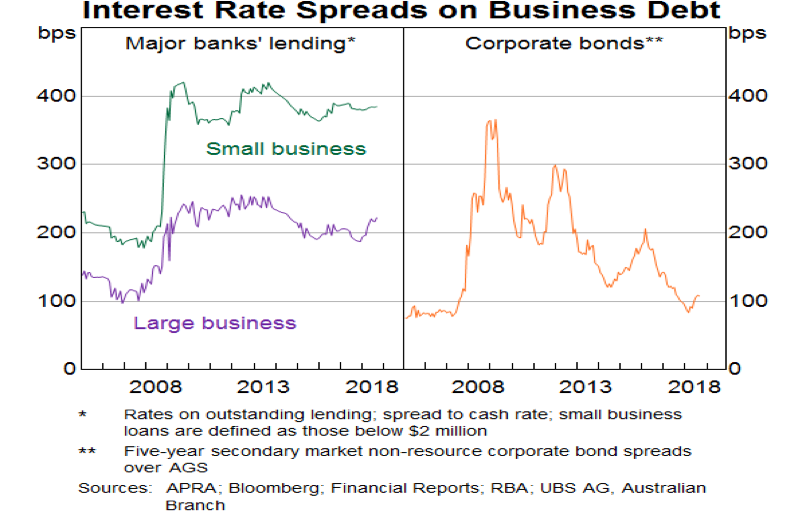

Even if you are able to secure a bank loan, the interest rates offered to small businesses tend to be significantly higher than those for larger businesses as it is a riskier investment for the bank – this is evident in the graph above.

Since there are alternative finance options available, you don’t need to get disappointed.

- SBA Loans

Getting an SBA loan is an excellent funding option for small businesses. These loans are provided under a program initiated by the Small Business Administration.

Lenders (usually banks), are encouraged to provide loans to smaller businesses at reasonably low interest rates for any business purpose, ranging from $5,000-$5,000,000. SBA itself does not lend money – it provides a guarantee to pay up to 80% of the amount, in case the borrower defaults.

- Venture capitalists

If you have a business idea that has growth potential, you can seek out venture capitalists, willing to invest in your business. These are investors who fund risky business ventures in return for an equity share in the company. Not only do they bring in money but also their expertise, which can be very useful for a small business with little experience of the industry.

- Partner financing

If you do not mind partnering with another business in your industry or with one that sells related products, partner financing is a viable option. It is beneficial for both parties – the partner provides funds in return for either a share of your sales or special rights of your product or its distribution.

If your partner is a larger business, you can receive other benefits from the collaboration such as, reaching out to their customers to expand your own market.

- Crowd funding

If you require a small loan for a creative project such as, a documentary or book launch, there are several crowd funding sites where you can put up your case and ask the general public for contributions.

Small amounts of funding from a large number of people adds up to be massive, helping you achieve your goals. You can offer free samples of your products as a token of appreciation in return.

- Home equity loan

Seeking a business loan by using their home as collateral is also an option utilized by many business owners. Once they are able to offer personal guarantee, they secure sufficient funds for their business. However, the option is risky as you put your home on the line, in case of a default.

The bottom line

To sum up, there are many options for smaller businesses to raise capital so they do not just have to rely on banks anymore. Look into the different financing options available in the market and choose the one that best suits your needs.

Leave a Reply