<Businesses can request an extension of up to six-months to file income tax returns by filing Form 7004. This guide provides an extensive overview of the information needed to complete Form 7004 successfully.>

Meeting IRS deadlines for filing tax returns is a critical aspect of business compliance. If your business can’t meet its deadline, there’s an option to file for a time extension. This blog offers a comprehensive overview of Form 7004, covering its deadline, required information, and other relevant topics.

What is IRS Form 7004?

To secure a business tax extension, use Form 7004, titled ‘Application for Automatic Extension of Time To File Certain Business Income Tax, Information, and Other Returns.’ True to its name, IRS Form 7004 is the go-to solution for a range of businesses seeking an extension on their tax filing deadline. This form enables you to extend the deadline for filing your business income taxes by up to six months beyond the regular tax season, accommodating various tax forms.

Who is eligible for a 7004 extension?

Most types of business entities can use a 7004 Form. The following entities request an extension using this form:

- C corporations

- Partnerships

- S corporations

- Limited liability companies (LLC) filing as a partnership

- Estates and Trusts.

What Information is Required to File Form 7004?

To properly fill out Form 7004, you must provide specific information about your business and its tax situation. Here are the details required to file Form 7004 with the IRS:

- Your name, address, and contact information

- Your identifying number (Employer Identification Number or Social Security number)

- Your business entity type

- Required tax form for which you’re filing an extension

- The tax you expect to be owed

You don’t have to include a signature when filing Form 7004.

Which Forms can be Extended Using Form 7004?

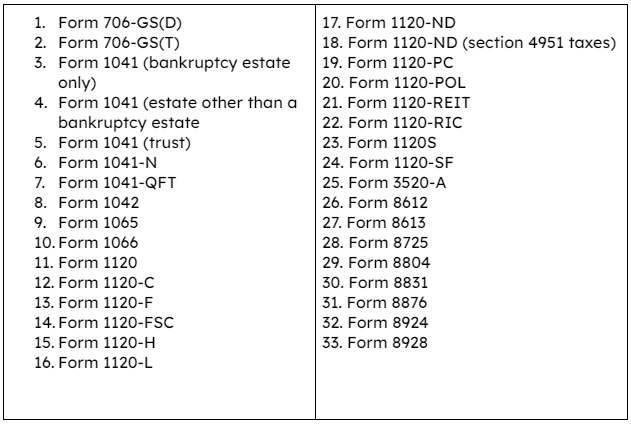

Businesses utilize Form 7004 to ask the Internal Revenue Service (IRS) for an extension to file their tax returns. Form 7004 can be used to request an extension for the following business tax forms:

Businesses file Form 7004 to request an extension of time from the Internal Revenue Service (IRS) for their tax returns. Form 7004 applies to the following business tax forms.

What is the IRS Form 7004 Deadline?

If you wish to extend the deadline for tax returns 1120, 1120S, 1065, 1041, and other forms must file Form 7004 with the taxes payable by the original date of the tax return.

The deadline for a business tax extension for the 2023 tax year to file Form 7004 with the IRS is:

- 15th day of the Third Month for certain tax returns, i.e., March 15 Every Year

- 15th day of the Fourth Month for certain tax returns, i.e., April 15 Every Year

How to File Form 7004?

Form 7004 offers the flexibility of submission either on paper or electronically. For enhanced security and efficiency, the IRS strongly recommends businesses opt for electronic filing.

Where should I mail Form 7004?

Form 7004 must be filled out and mailed to the IRS if you choose to file it on paper. The mailing address for your Form 7004 may change depending on the following elements :

- The tax return for which you have requested an extension.

- The state in which your major business office or agency is situated.

- The value of your asset(s) at the end of the tax year.

Switch to E-Filing of Form 7004 with ExpressExtension!

ExpressExtension offers an easy option to file 7004 online accurately and efficiently with the IRS. With the help of our software, you can quickly fill out Form 7004 step-by-step and finish your extension in a matter of minutes.

With ExpressExtension, you can pay your tax dues and get real-time IRS status updates on your extensions.

To get started, register for a free ExpressExtension account now! You can complete your extension quickly and only pay when you transmit it to the IRS.

Leave a Reply