How do you review your investments? We give Jemstep a test-drive to see if it’s worth your time and money.

As OG bemoaned last week when writing about his broken garage door, at some point, calling a professional is the right move. In the comments, there were some wonderful discussions about finding “experts” without consulting with a person locally by using YouTube videos, better online tools and calling trusted friends.

The Middle Ground in Asset Allocation

There’s plenty of middle ground between wingin’ it and hiring a financial advisor when picking the right basket of investments. One tool I’ve had the opportunity to test drive is Jemstep. After meeting a Jemstep rep at FINCON last year, I was impressed enough with the product to have Simon Roy, the firm’s president, on our 2 Guys & Your Money podcast. He informed me that they were upgrading the product, and now it’s available.

The “New” Jemstep Portfolio Manager

Jemstep is a program that helps you diversify your investments. You know that dartboard you’ve been throwing at? No longer. Jemstep takes the guesswork out of discovering which investments you should be using and pinpoints suitable replacements for duds (or, surprisingly, good investments in asset classes that really don’t meet your investment needs). During my trial run, JemStep told me some things I’d (shamefully) already knew: I’d let my winners run a little too long, and Jemstep recommended cutting back in those “overgrown” areas where the risks now exceeded the chance for rewards.

How Jemstep Portfolio Manager Works

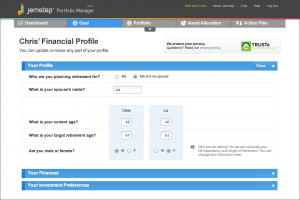

The Jemstep approach is consistent with that of an advisor. First, JemStep asks you questions about your goals. What do you need your portfolio to do? It asks questions about how far away the goal is, how much you may need to access at a time, and other relevant questions. I found this process fun. The interface is intuitive and the style of the website draws you in.

Jemstep asks you for information about your retirement goal, among others. The interface is easy to use, and the blue lines below tell you just how far you still have to go: I have to still fill in information on my finances and investment preferences.

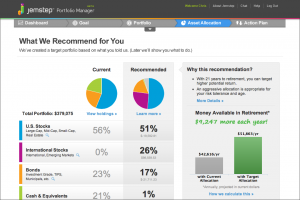

Once you’ve answered goal-related questions, you can upload your portfolio directly from your broker or add in funds manually. Finally, JemStep does it’s work and voila….gives you the correct asset allocation for your goal.

Here is the basic recommended portfolio. With these changes, I stand to gain over $9,000 per year in retirement. Yee-haw!

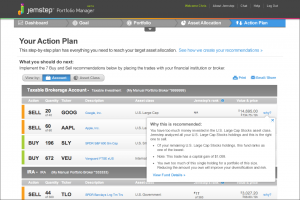

The premium version of Jemstep includes lists of what investments you should sell (in many cases only trim back), which investments you should accumulate, and new suggestions for your portfolio (often in asset classes that don’t exist in your portfolio). Here’s what that looks like:

Jemstep not only tells me which investments to sell, but alerts me to potential capital gains taxes. Every sell recommendation is accompanied by a detailed reason why this investment is on the chopping block. In this case: Apple is one of my worst performers and I have too much individual stock for a portfolio of this size.

The Cost

The Jemstep pricing model isn’t surprising. You can access basic advice for free (this includes the asset allocation you should be using, plus the differences between your portfolio and the suggested one). The premium model, which includes continuous tracking, rebalancing advice, a detailed breakdown of recommended sale quantities and investments, is also free for people just starting out. Pricing begins at $17.99 per month for portfolios over $25,000, and increases based on the amount of money Jemstep is helping you manage. While some who are looking for a freebie might be turned off by the price, this is less than the 1% fee often charged by a financial pro. Want professional advice in your corner without having to sit in an office with some team of people? Great. Jemstep won’t call you with hot stock tips and is there when you need it. In exchange, you’ll pay a model comparable to those used by seasoned investors for less than half the cost.

What I Like, What I Don’t

Here’s what I love: this asset allocation is a proven winner that points you toward the low cost, high return investments in a balanced portfolio. If you’ve ever wanted to have a well-managed portfolio but didn’t know where to start, Jemstep is a great place to begin. Different than some generic asset allocation models that I’ve used, JemStep points you toward specific investment options. For the person who wants to make sure they have low cost investments with a proven track record, Jemstep is for you.

Jemstep partnered with Windham Capital Management to create their recommendations. When back-tested against the S&P 500, Jemstep’s recommended portfolio was impressive: all five of their model portfolios outperformed the S&P 500 over the last 14 years with significantly less risk.

Here’s what I don’t like: results. Yes, JemStep provides impressive results, but will you use them? As I’ve stated before, financial advisors exist for one reason: to make sure that the job is finished. When people left my office, the portfolio moves were complete and people could go about their lives, knowing that the important decisions had been made. A JemStep rep was excited to tell me that 12% of JemStep users actually made changes to their portfolio “because it’s so hard to get people to take action.”

She’s right on.

While 12% usage is a great number for an often-free tool used by people on the internet, you should examine yourself. Are you going to follow through and actually take the advice on JemStep? If you don’t trust yourself to do the job, pay more and hire a human being who’ll give you a shove.

Overall Impression

If you’re managing your own money and aren’t sure how to do it well, give Jemstep a shot and follow the recommendations. If you don’t like your advisor or wonder if the recommendations you’re receiving are any good, take the time to use JemStep to give yourself a “second opinion.” The tool is robust enough that you’ll know immediately if your advisor isn’t diversifying your portfolio in a way that makes sense for your goals.

Jemstep can be found at Jemstep.com. I am not an affiliate of Jemstep and was not compensated for this review.

Thanks for sharing with us. Seems like a nifty tool that could help retail investors tremendously!

Thanks for the tip. Like the idea behind the website and seem relatively comprehensive. I’ll sign up and give it a test drive. Definitely a big move at hand in the online financial advice space and I like it. Have tried some of the others but still looking for the one that ticks most of my needs.

I was impressed by the site. It might not meet your needs either, but I love that the basic manager is free. According to Jemstep it will always be free.

This is interesting but I have always come out better by making things easier.

The cool thing is atleast you can try it for free to see if its worth buying.

What will this help you accomplish saving or maximizing ROI?

That’s the problem, Darnell…it won’t help you save money. It’ll help you get higher returns with less risk and lower fees….so it’s maximizing ROI.

Nice review Joe. I hadn’t heard of Jemstep, and I just may be interested in checking this out. I’ll click your links before I do.

Thanks, Greg, but I don’t have an affiliate program with them. They don’t have one at all. I like the product enough that I’d join it if they did, though….

I hadn’t heard of Jemstep either, its an interesting concept. I will have to check them out. Thanks!

I may have to give this a test run. I actually hadn’t heard of it until this post.

I like the fact that you CAN take it for a test run. It’s an attractive, smart tool.

Sounds like it’s worth checking out, Joe. Thanks for the valuable info!

Jemstep sounds like it does a great job of keeping people realistic and on track about their goals and assets.

I really like the tracking features. They make it easy to tweak your portfolio (or “rebalance” as they say….).

Average Joe – many thanks for the comprehensive review of Jemstep Portfolio Manager, and thanks also to your readers for the interest and comments above. We hope they find real value from our new Portfolio Manager service and appreciate them taking time to try it out. I’d be happy to answer any questions or provide more information, and we encourage comments and feedback in an effort to continually give investors what they need. Thanks again.

Kevin Cimring

CEO, Jemstep

Thanks back to you and your team, Kevin, for helping make it easy to review and answering all of my questions.