This year’s tax deadline has passed but you still have until October to do Roth IRA conversions.

When thinking about converting from a traditional IRA to a Roth IRA, not only do you have to figure out how much to convert, but you also need to think about when and over how long of a time period.

When using a traditional IRA, you contribute your dollars pre-tax, and you will pay taxes only when you withdraw later in retirement. Roth IRAs are a bit different. You cannot deduct the contributions from your taxes, but when you withdraw later on, nothing is taxed.

In general, the goal is to minimize your taxes. But it’s a bit more complex than that. It also depends on the timing of the tax savings.

The Roth IRA vehicle was only created 20 years ago. It is just now starting to become mainstream. Although most people should probably not convert to a Roth IRA, it is worth it for nearly everybody to at least find out if it makes sense for them. The tax savings could be enormous.

Moving Tax Brackets

If you think you will be in a higher tax bracket when you retire, or if you know you will have very lot tax years coming up, you should definitely look into whether or not a Roth conversion makes sense.

One reason many people cite for wanting to convert a traditional IRA to a Roth is the lure of early retirement. Let’s look at a case study. We have a person, John, who wants to retire when he’s 50. The problem here is that John cannot use his IRA money (without a 10% penalty) until he’s 59.5.

- Transfer all IRA money to a Roth IRA.

- Pay the taxes on the transfer (you will be your marginal income tax rate on this). If possible, pay the taxes out of taxable accounts and not out of the IRA itself.

- Wait at least five years and then begin to withdraw from the Roth IRA, tax-free and penalty-free.

This strategy will allow John to begin using his retirement money at age 55 rather than age 59.5 and he won’t pay the 10% penalty.

Now let’s look at running some actual numbers to see when a conversion makes sense.

Running The Numbers

Let’s look at another case study. John and Jane are 54 years old. They plan on retiring next year. They will be start receiving large pensions at age 62 and social security at age 67. Currently their federal tax rate is only 10%, but that will increase dramatically at age 62 when their pensions kick in. This is a perfect example of a couple who should probably do a Roth conversion.

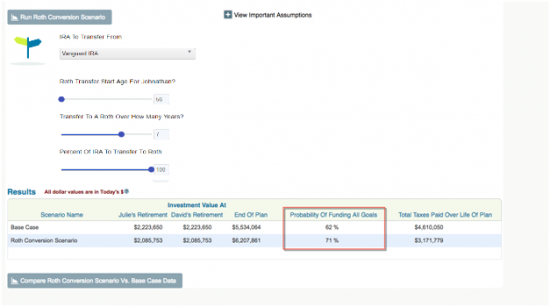

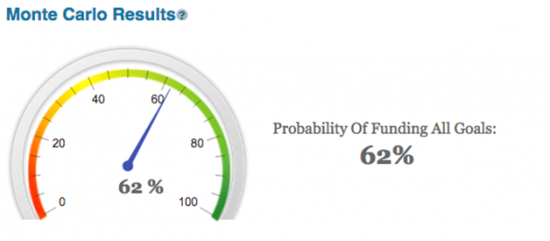

But what if they convert their entire $600,000 IRA to a Roth over a seven year period when their tax rate is low? I ran this scenario and it helps them quite a bit. The results are below:

Their probability of never running out of money jumps by 9%. Part of the reason is that their tax burden would decline by nearly 30%, as you see in the table above.

A Roth conversion is not for everybody, but for some it could be a life-saver in retirement.

Read More

- Will My 401(k) Last the Rest of My Life?

- How to Split an IRA or 401(k) in a Divorce

- Five 401(k) Alternatives You Need to Know About

- Saving to Boost Your 401(k)

- IRS Announces 2018 Pension Plan Limitations

- Avoid These Common Mistakes When Planning for Retirement

- How to Save for Retirement

- Investing Your Way to Retirement

Leave a Reply