I was late to work and sneaking up the stairwell to my office. A passing friend said, “A second plane just hit the World Trade Center.”

There’d been a first plane? The World Trade Center? It must be a little Cessna.

The entire office huddled around televisions. I wasn’t prepared for what they were watching. The heroism of everyday people that day still amazes me.

Later in the week, among the flurry of stories echoing the disaster, one personal finance problem emerged: private financial documents with personal client information littered the streets of Manhattan. Many of the firms in the World Trade Center were financial companies (in fact, one firm owned by a cousin of a client, Alger Mutual Funds, lost David Alger and 35 other staffers that day). I began helping the media complete stories about “How to Protect Your Privacy.”

Although we can’t prevent another 9-11, we can make sure that our financial documents are the last thing we worry about when far more important concerns (such as people) should dominate our thoughts. Here are five lessons I took far more seriously after that day than I had previously:

5 Steps To Protect Your Identity

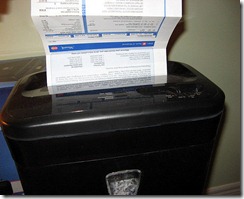

1) Shred unnecessary documents. A good shredder pays for itself immediately. If you’re using it for household bills, this Amazon shredder will only set you back $29.99. Businesses should invest in a more robust tool.

1) Shred unnecessary documents. A good shredder pays for itself immediately. If you’re using it for household bills, this Amazon shredder will only set you back $29.99. Businesses should invest in a more robust tool.

2) Don’t give out your social security number, telephone number, or other unnecessary information on documents. I hand over wrong numbers like a hot woman at the bar. Create a separate email address reserved for email forms and correspondence with companies.

3) Check your credit report regularly. You’ll want to keep a tight watch over predators trying to access your credit. Companies with free credit tools like Quizzle or CreditKarma are great places to monitor lender activity. On episode #2 of our Two Guys & Your Money podcast, Len Penzo reported that he turns off his credit with each credit company until he needs it. Look for other mistakes while you’re there: a recent ABC news story reported that over 90% of all credit reports have inaccurate information.

4) Review every credit card statement. Ever wonder why Mr. Monopoly looks shocked when you draw the “Bank Error in Your Favor….Collect $40” card in the popular board game? It’s because errors happen all the time and they’re rarely in your favor. More importantly, you may see early signs of thieves trying to gain access to your credit.

5) Back up your documents – I’ve recently begun transferring my paper documents into digital form. Keep these in two places in case you lose access to the first or thieves steal the data.

Foremost in my mind today is the tragic and unnecessary loss of life on 9-11. I learned far greater lessons than the five I pointed out above. However, I also learned a little about taking care of my financial life so that if tragedy strikes, the threat to my identity is minimized.

What steps do you still need to take to better protect your financial privacy?