Canva

How you spend and give your money is crucial in creating a balanced financial plan. Achieving financial stability and meeting your goals requires strategic planning and mindful decisions. Here are ten key aspects to help you craft a balanced financial plan that aligns with your values and aspirations.

1. Setting Clear Financial Goals

Start by defining your financial goals, both short-term and long-term. These could include saving for a home, retirement, or an emergency fund. Clear goals provide direction and motivation for your financial decisions. Break down larger goals into smaller, manageable steps. Regularly reviewing and adjusting your goals ensures you stay on track.

2. Budgeting for Essentials

Budgeting is crucial for managing how you spend and give your money. List all your essential expenses, such as housing, utilities, groceries, and transportation. Allocate a portion of your income to cover these necessities first. Use budgeting tools or apps to track your spending and stay within your limits. Prioritizing essentials helps prevent overspending and financial stress.

3. Allocating for Savings

Incorporating savings into your financial plan is essential for future security. Aim to save at least 20% of your income each month. Automate your savings to ensure consistency and reduce the temptation to spend. Consider various savings goals, such as an emergency fund, retirement, and major purchases. Regular savings build a financial cushion for unexpected expenses and long-term goals.

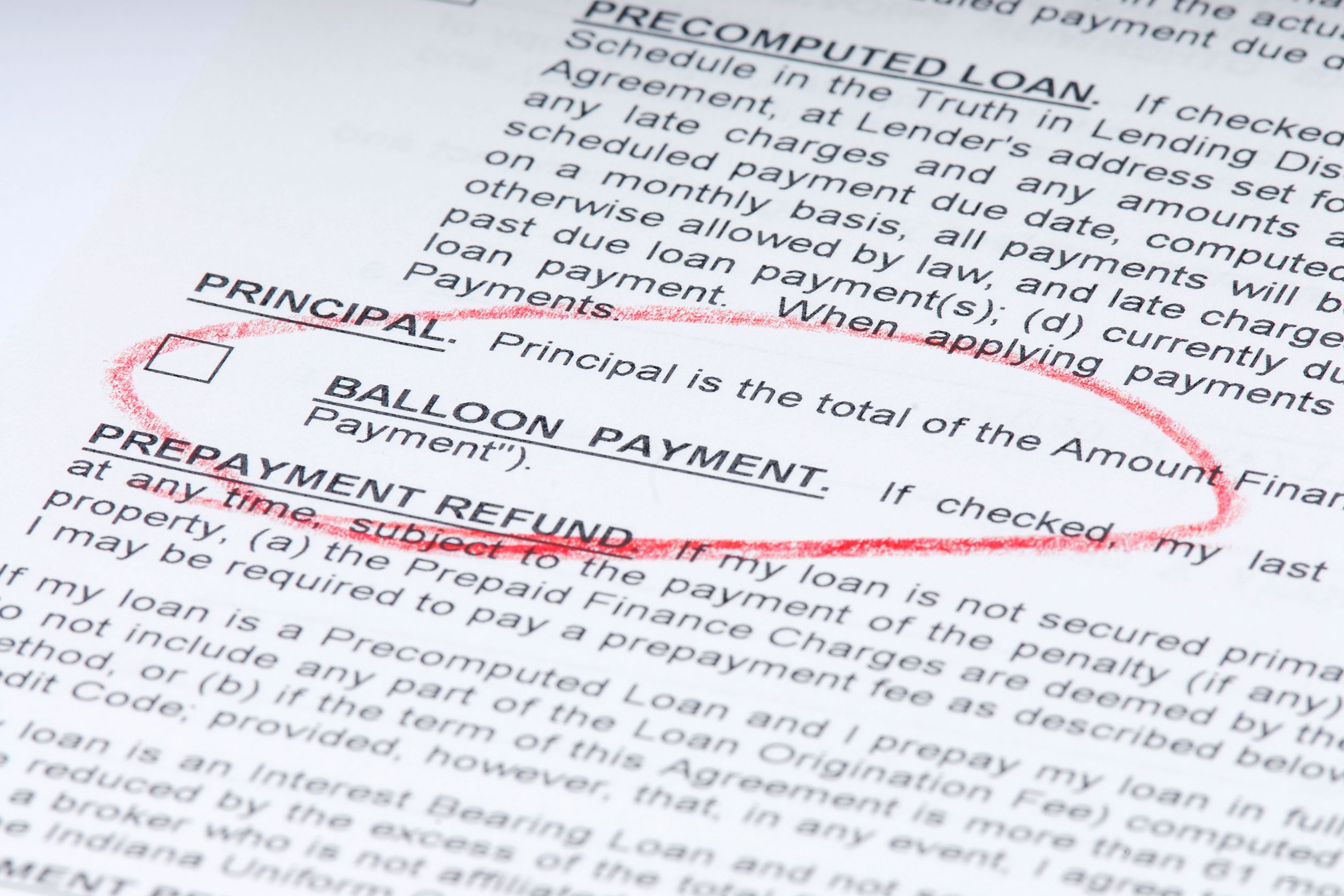

4. Strategic Debt Management

Canva

Effective debt management is a key component of a balanced financial plan. List all your debts, including credit cards, loans, and mortgages. Prioritize paying off high-interest debt first to reduce overall costs. Consider debt consolidation options to simplify payments and lower interest rates. Developing a repayment strategy helps you become debt-free faster.

5. Smart Investment Choices

Investing wisely can significantly boost your financial growth. Research different investment options, such as stocks, bonds, and real estate. Diversify your portfolio to spread risk and increase potential returns. Consult a financial advisor to create an investment strategy that aligns with your goals and risk tolerance. Regularly review your investments to ensure they perform well.

6. Charitable Giving

Incorporating charitable giving into your financial plan reflects your values and supports causes you care about. Decide how much of your income you can allocate to donations. Research organizations to ensure your contributions make a meaningful impact. Consider setting up automatic donations to maintain consistency. Charitable giving can provide personal satisfaction and community benefits.

7. Managing Lifestyle Expenses

Balancing lifestyle expenses is crucial for maintaining financial health. Identify non-essential spending, such as dining out, entertainment, and hobbies. Set a reasonable budget for these discretionary expenses. Look for ways to enjoy activities affordably without compromising your financial goals. Mindful spending helps you enjoy life while staying financially responsible.

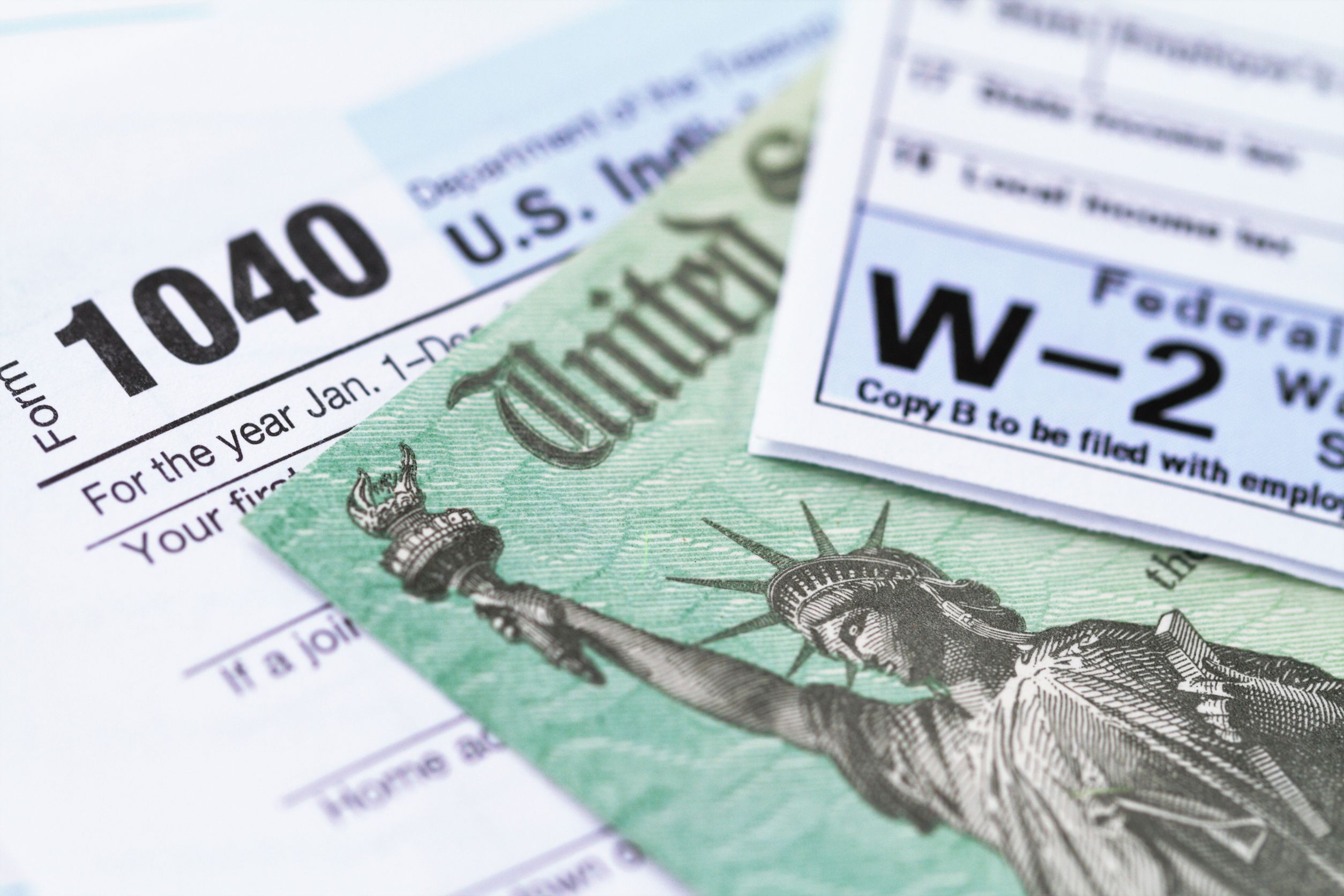

8. Planning for Taxes

Canva

Tax planning is an important aspect of managing how you spend and give your money. Understand your tax obligations and explore ways to minimize your tax burden legally. Utilize tax-advantaged accounts like IRAs and 401(k)s for retirement savings. Keep thorough records of your income, expenses, and deductions. Consulting with a tax professional can optimize your tax strategy.

9. Reviewing and Adjusting Your Plan

Regularly reviewing and adjusting your financial plan ensures it stays relevant to your changing needs. Set aside time each month to evaluate your budget, savings, and investments. Make adjustments based on life changes, such as a new job, marriage, or having children. Flexibility in your financial plan allows you to adapt and stay on course. Continuous improvement is key to financial success.

10. Seeking Professional Guidance

Professional financial guidance can enhance your financial planning efforts. Financial advisors, accountants, and planners can provide expert advice tailored to your situation. They can help you navigate complex financial decisions, from investing to estate planning. Regular consultations ensure your financial plan remains effective and aligned with your goals. Professional support can be invaluable for achieving long-term financial stability.

Achieving Financial Balance

Creating a balanced financial plan requires careful consideration of how you spend and give your money. By setting clear goals, budgeting wisely, saving consistently, and seeking professional advice, you can achieve financial stability and meet your aspirations. Regularly reviewing and adjusting your plan ensures it remains effective and aligned with your evolving needs. Embrace these strategies to build a secure and fulfilling financial future.

Student loan debt is a significant financial challenge for millions of graduates. With the rising cost of education, more students are relying on loans to fund their college degrees, resulting in substantial debt upon graduation. This financial burden can impact various aspects of life, including the ability to save for retirement, purchase a home, or even pursue further education. The weight of student loans can also cause stress and anxiety, making it essential to find effective ways to manage and reduce this debt.

Student loan debt is a significant financial challenge for millions of graduates. With the rising cost of education, more students are relying on loans to fund their college degrees, resulting in substantial debt upon graduation. This financial burden can impact various aspects of life, including the ability to save for retirement, purchase a home, or even pursue further education. The weight of student loans can also cause stress and anxiety, making it essential to find effective ways to manage and reduce this debt.