Image source: pexels.com

Running a small business is a constant balancing act. Every decision, big or small, can have lasting effects on your company’s future. While there are many challenges entrepreneurs face, there is one mistake that can destroy a small business in 24 hours. It’s not a dramatic theft, a fire, or even a lawsuit—though those are all serious in their own right. Instead, it’s something deceptively simple, and it can sneak up on even the most cautious owners. Understanding this risk is critical if you want your business to survive and thrive in today’s fast-moving world. Let’s break down what this mistake is, how it happens, and what you can do to avoid it.

1. Ignoring Cash Flow Management

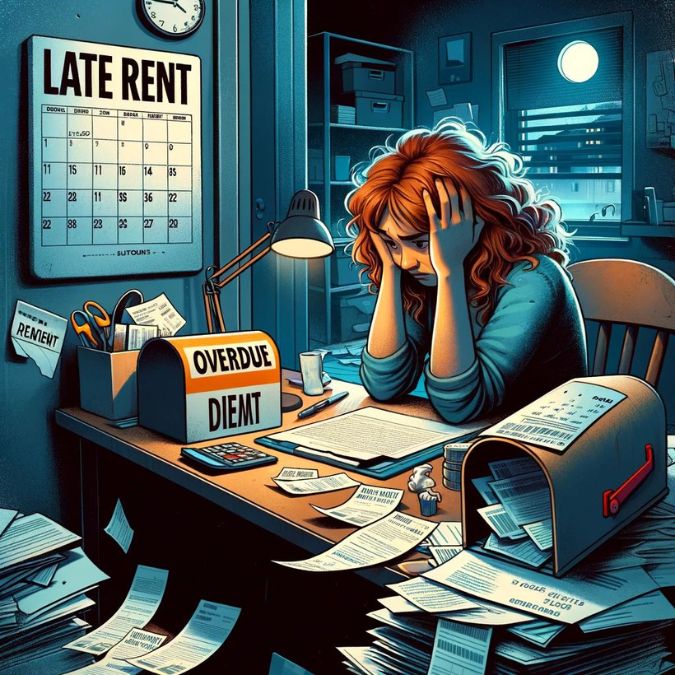

The one mistake that can destroy a small business in 24 hours is ignoring cash flow management. Cash flow is the lifeblood of any business, no matter the industry or size. Without enough cash on hand, you can’t pay your employees, suppliers, or even keep the lights on. Many business owners focus on revenue and profits, but overlook the day-to-day flow of money in and out of their accounts.

For example, you might have thousands in outstanding invoices and think your business is doing well. But if your clients are slow to pay and your bills are due, you’ll quickly run into trouble. Even a single missed payroll or late payment to a key vendor can start a chain reaction. Employees lose trust, vendors stop delivering, and suddenly your business’s reputation and operations are at stake. This is why mastering cash flow management is essential for every small business owner.

2. Overestimating Sales Projections

Another common trap is overestimating how much money will come in each month. Optimism is important, but when it comes to financial planning, realism is even more critical. Overly rosy sales projections can lead you to spend money you don’t actually have. This can mean taking on unnecessary expenses, hiring too quickly, or investing in inventory that sits unsold.

If sales fall short, your cash flow suffers. Even a brief dip in revenue can leave you scrambling to cover essential costs. This is a textbook example of how a small business can be destroyed in 24 hours by a single unexpected shortfall, leaving you with unpaid bills and unhappy stakeholders.

3. Failing to Monitor Expenses

Small expenses add up fast. It’s easy to sign up for software subscriptions, upgrade office equipment, or approve travel costs without considering the bigger picture. But if you don’t keep a close eye on your spending, you may find that your outflows are outpacing your income.

When cash flow problems hit, you may not have time to cut costs or negotiate better terms with vendors. That’s why business owners must regularly review their expenses and trim unnecessary costs before they become a crisis. Even a minor oversight can be the mistake that can destroy a small business in 24 hours if it leaves you unable to meet your financial obligations.

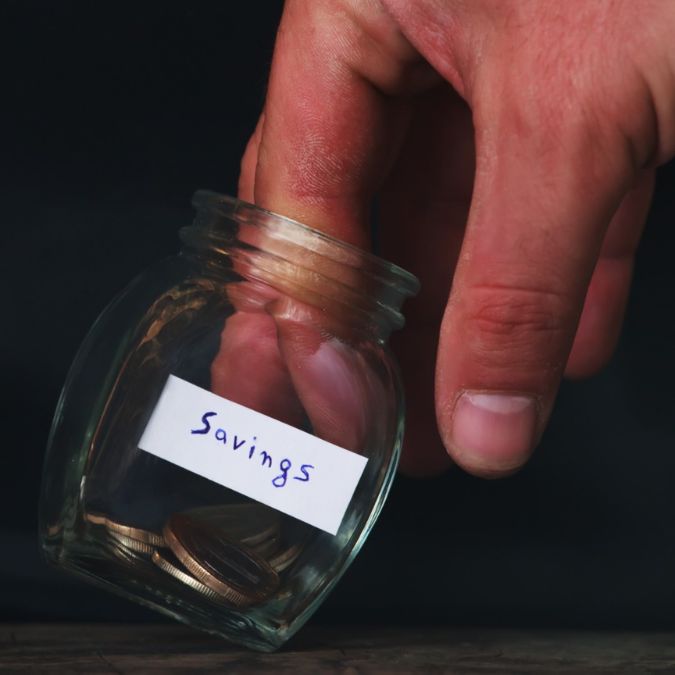

4. Not Having a Cash Reserve

Many small businesses operate without a financial safety net. This leaves them vulnerable to sudden emergencies, slow-paying clients, or unexpected expenses. Without a cash reserve, even a single bad day can mean the difference between survival and closure.

Building up a cash reserve doesn’t happen overnight, but it should always be a priority. Set aside a percentage of your profits each month, even if it’s a small amount. This buffer can give you the breathing room you need to weather storms and avoid the mistake that can destroy a small business in 24 hours.

5. Neglecting to Reconcile Accounts Regularly

Reconciling your accounts may not be the most exciting task, but it’s one of the most important. If you’re not regularly checking your bank statements against your accounting records, you may miss errors, fraudulent charges, or missed payments. These issues can quickly snowball, leading to cash shortages you didn’t anticipate.

Set aside time each week to review your financials. Use accounting software or hire a bookkeeper if needed. The time you invest here can prevent the mistake that can destroy a small business in 24 hours and keep your finances on track.

Staying Vigilant: Your Best Defense

The reality is that the mistake that can destroy a small business in 24 hours usually stems from complacency. It’s easy to assume that things are fine as long as you’re making sales and paying bills. But without careful cash flow management, even a successful business can collapse in a single day. Stay proactive by reviewing your finances often, building up a cash reserve, and planning for the unexpected.

What steps have you taken to protect your business from cash flow problems? Share your experiences or questions in the comments below!

What to Read Next…

- 5 Emergency Repairs That Could Force You Into Debt Overnight

- 7 Hidden Fees That Aren’t Labeled As Fees At All

- 7 Financial Loopholes That Lenders Exploit Behind The Scenes

- 10 Ways You’re Wasting Money Just Trying To Keep Up Appearances

- Are These 7 Little Expenses Quietly Costing You Thousands A Year?

Travis Campbell is a digital marketer/developer with over 10 years of experience and a writer for over 6 years. He holds a degree in E-commerce and likes to share life advice he’s learned over the years. Travis loves spending time on the golf course or at the gym when he’s not working.