Image Source: 123rf.com

The transition to retirement is a significant milestone in a couple’s life, often filled with anticipation and excitement. However, when one partner retires before the other, it can create a unique set of challenges that require careful navigation.

The shift in daily routines, financial dynamics, and emotional well-being can strain even the strongest relationships. Understanding these challenges and developing effective coping strategies is crucial for maintaining harmony and happiness during this transformative phase. This period can be very stressful for couples.

1. Adjusting to Different Daily Routines

When one partner retires, their daily routine undergoes a dramatic shift, while the working partner’s routine remains largely unchanged. This disparity can lead to feelings of isolation and resentment, as the retired partner may feel aimless while the working partner feels overwhelmed. Establishing a new shared routine that accommodates both partners’ needs is essential, creating a sense of balance and harmony. Open communication and flexibility are key to navigating this adjustment period, ensuring that both partners feel valued and supported. This is a common issue for many couples.

2. Navigating Financial Changes

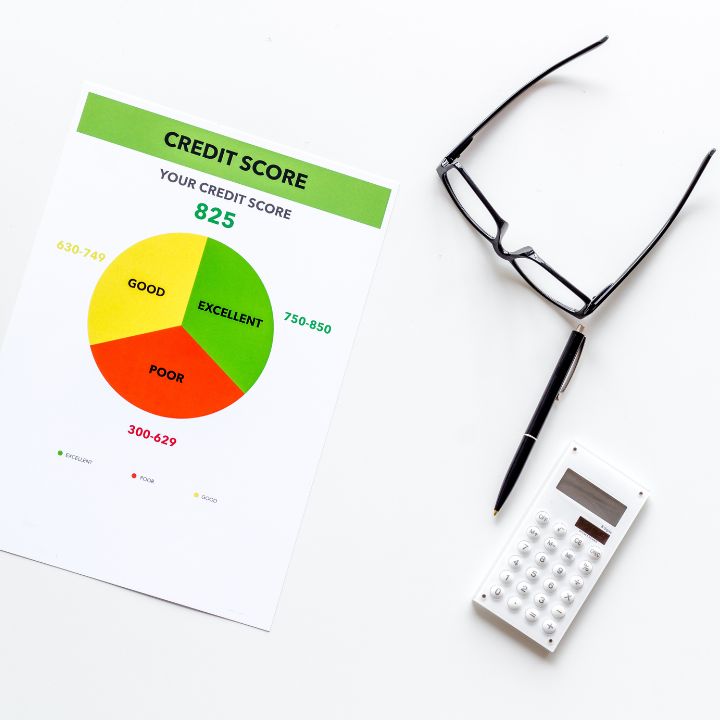

Retirement often brings about significant financial changes, particularly when one partner’s income ceases. This can create anxiety and tension within the relationship, especially if the couple hasn’t adequately planned for retirement. Developing a comprehensive financial plan and communicating openly about financial concerns is crucial, ensuring that both partners feel secure and informed. Seeking professional financial advice can provide valuable guidance during this transition, helping to mitigate financial stress. Many couples struggle with these changes.

3. Maintaining Emotional Well-Being

Retirement can trigger a range of emotions, from excitement and relief to anxiety and a sense of loss. The retired partner may struggle with a loss of identity or purpose, while the working partner may feel burdened by increased responsibilities. Open communication and emotional support are essential for maintaining emotional well-being, creating a safe space for both partners to express their feelings. Engaging in activities that promote relaxation and stress reduction, such as exercise or meditation, can also be beneficial. This time can be very emotional.

4. Redefining Roles and Responsibilities

Image Source: 123rf.com

Retirement often necessitates a redefinition of roles and responsibilities within the relationship. The retired partner may take on more household chores or caregiving duties, while the working partner may feel pressured to maintain their career. Establishing clear expectations and communicating openly about household tasks and responsibilities is crucial, ensuring that both partners feel valued and respected. This is a good time to discuss these changes.

5. Balancing Individual and Couple Time

Retirement can lead to an imbalance between individual and couple time, as the retired partner may have more free time than the working partner. It’s important to find a balance that accommodates both partners’ needs, ensuring that they have time for individual pursuits and shared activities. Scheduling regular date nights and individual activities can help maintain a healthy balance, fostering a sense of independence and connection. Balancing time can be very difficult.

6. Addressing Differing Retirement Visions

Couples may have differing visions for retirement, with one partner envisioning travel and adventure while the other prefers a quiet and relaxed lifestyle. Communicating openly about retirement goals and finding a compromise that satisfies both partners is crucial, ensuring that their retirement years are fulfilling and enjoyable. Flexibility and compromise are essential for navigating these differences, and can help to keep the relationship strong.

7. Managing Increased Time Together

Spending significantly more time together can be a double-edged sword, leading to increased intimacy or heightened tension. It’s important to establish healthy boundaries and maintain individual interests, ensuring that both partners have space for personal growth. Engaging in activities that promote independence and shared interests can help manage increased time together, and can help the relationship.

8. Adapting to Changes in Social Dynamics

Retirement can lead to changes in social dynamics, as the retired partner may lose contact with colleagues or professional networks. Maintaining social connections and engaging in new social activities is crucial for both partners, ensuring that they feel connected and supported. Joining clubs or volunteering can help expand social circles, and can help to make new friends.

Challenging But Rewarding

The retirement transition can be a challenging but rewarding experience for couples, requiring open communication, flexibility, and a willingness to adapt to change. By understanding the potential challenges and developing effective coping strategies, couples can navigate this phase of life with grace and resilience, strengthening their bond and creating a fulfilling retirement together. This is a time of change.

What challenges have you faced during retirement transitions? Share your experiences and tips below, and help others navigate this phase!

Read More:

7 Ways Retirement Can Be Cheaper Than You Can Imagine

8 Reasons Your Kids Don’t Want To Be Your Retirement Plan

Latrice is a dedicated professional with a rich background in social work, complemented by an Associate Degree in the field. Her journey has been uniquely shaped by the rewarding experience of being a stay-at-home mom to her two children, aged 13 and 5. This role has not only been a testament to her commitment to family but has also provided her with invaluable life lessons and insights.

As a mother, Latrice has embraced the opportunity to educate her children on essential life skills, with a special focus on financial literacy, the nuances of life, and the importance of inner peace.