My parents are in town! While I’m partying with my peeps, this guest article was written by our friend Julian over at Frugaal. Frugaal is a website that provides online stock and forex broker reviews, and it also contains a blog focusing on a broad range of financial and frugal-living topics. Enjoy!

You may think that investing is too complicated and difficult for you–especially if you have a very small amount that you’re able to invest. But over the past few years, the internet has made investing a possibility for anyone. Now, using online brokers, even if you only have a very small portfolio you can get all the benefits that the large investors do, just on a smaller scale. Of course, make sure you check out all the options available for you at the different brokerage companies but, in the meantime, take a look at these six simple investing tips for beginners.

Start small, and also don’t be deterred if you don’t have much cash to invest

In the past, it was impossible to start a portfolio with a very small investment. However, now you can get started with as little as $100. In fact, this it’s a good idea to start of small so you can learn the ropes before you start to take things seriously. So get your feet wet by buying a small portfolio containing mutual funds for example; this will give you an idea of how the stock market works and will mean you won’t risk more than you can afford to. However, by choosing wisely, you can find funds that are highly unlikely to ever lose major ground; they just may not have as high of a return as those that are more volatile. When purchasing stocks, beginners should also ideally go to discount online brokerages where, although the level of service will not stretch beyond deal-execution, you will avoid any expensive fees.

Do your homework

This tip doesn’t mean to say it’s a good idea to shell out a ton of money on books and even online or offline tutorials and courses. Instead, it means harnessing the wide range of readily available, free educational tools that are out there. So follow blogs that specifically focus on stock investing; read the financial papers to get an idea of what stocks you might like to purchase; join online forums (often found on the websites of online brokerages) to pitch your questions and ideas to others who have been in the game for longer and are more knowledgeable than you; and, as the very first starting point, be sure to understand some of the basic principles and rules of economics, accounting, and corporate finance. Ultimately, remember that a few Google searches and a few hours spent reading will get you a long way to begin with all this.

Monitor your investments

After you buy your first stocks, check up on them regularly. While you don’t want to become obsessed with checking them several times a day, this is your money that you’ve invested, so you should keep an eye on how things are going. Only by carefully monitoring the investments will you start understanding what makes them go up or down in value over time. A great way of monitoring your investments is by harnessing the capabilities of Google Finance. You can then also get yourself a Google Docs stock portfolio monitoring spreadsheet. The best thing is, both of these services are completely free.

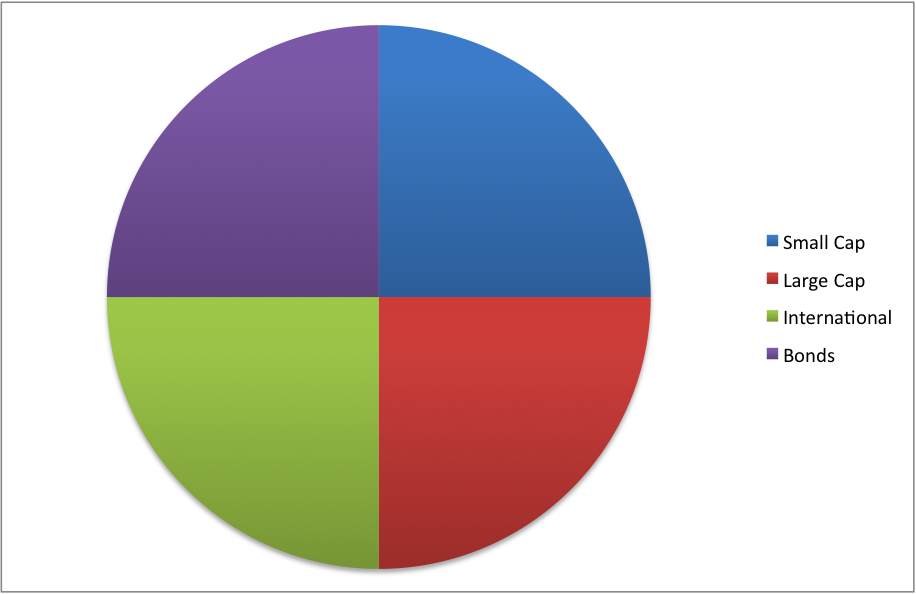

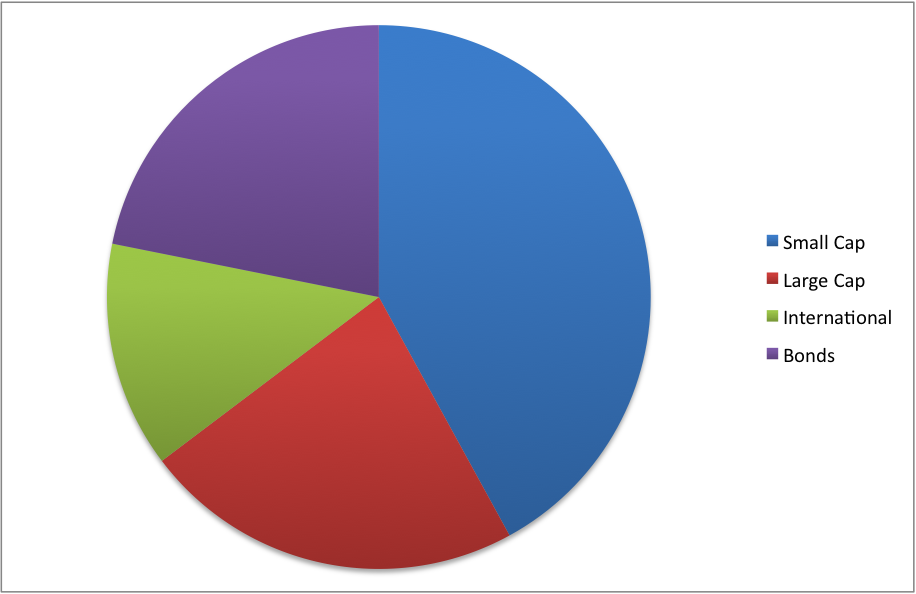

Diversify

In some ways this should be on this list, but in other respects, it shouldn’t. If you have a diverse portfolio you’ll be mitigating against the risk of losses by spreading your investments across a diverse portfolio. Although in principle this is great, the reality is that it’s not possible to get your hands on a truly diverse portfolio with only a small amount of funds unless you buy into an index fund. So don’t be too hung about not being able to foster a diverse portfolio yourself if you don’t have the funds to do it.

Make investing a priority

If you want to add to your portfolio regularly, make investing a priority in your life. The old adage is that you should pay yourself first, meaning you should put aside money for savings before you pay your bills and buy things you need or want. This is excellent advice. Each paycheck, set aside a certain amount that you wish to invest, say 5% for example. It may not be much, but over time it will add up and your portfolio will grow. Investing is also a great thing to get into if you want to reel in your spending sprees and start to look towards the future, particularly if you’re a young adult. This is because unlike placing money into a savings account – a fairly passive and dull activity – investing can be exciting and it can become a new interest of yours, but one that will also allow you to build a healthy nest egg for later on in life too.

Have patience

Investing is not about getting rich overnight. Have patience with your chosen investments. There’s a very good chance they’ll grow and over time will begin to provide you with the financial return you were after. So if you’re after a quick return, investing won’t be the right method of savings for you; remember, investing is for those with time to wait for the market to dictate the rewards. Also, at the very basic level, make sure you’re not duped by any advert or website suggesting ‘get rich quick’ schemes through stock investing either. Put simply, there’s no magic bullet when it comes to stock investing, so don’t try and look for one.

Thanks for filling in, Julian! With the 4th quarter here, it’s time to cha-ching! on your investments. Okay, crew, your turn. Any tips to pile on top of Julian’s for your internet friends (or as my buddy Kathleen says, “the friends in your computer?”

Joe is a former financial advisor and media representative for American Express and Ameriprise. He was the “Money Man” at Detroit television WXYZ-TV, appearing twice weekly. He’s also appeared in Bride, Best Life, and Child magazines, the Los Angeles Times, Chicago Sun-Times, Detroit News and Baltimore Sun newspapers and numerous other media outlets. Joe holds B.A Degrees from The Citadel and Michigan State University.