DALL-E

In today’s fast-paced financial world, your mindset can be your greatest asset or your most limiting factor. The concept of a “poverty mentality” refers to a set of beliefs and attitudes that unconsciously sabotage one’s financial potential.

It’s not just about the balance in your bank account; it’s about how you perceive money, risk, and opportunity. This mentality often leads to behaviors and decisions that keep people in a cycle of financial struggle, despite their best efforts to escape it.

Here are ways this mindset can hinder your financial future and offers insights into how shifting your perspective can pave the way to greater wealth and prosperity. Get ready to challenge your beliefs, rethink your strategies, and embark on a transformative journey towards financial liberation.

1. Overvaluing Extreme Couponing

DALL-E

Extreme couponing might seem like a savvy way to save money, but it can often lead to spending on unnecessary items just because they’re on sale. This approach can clutter your life with unneeded products and distract from focusing on more significant financial strategies. Furthermore, the time and energy spent on extreme couponing can often be better invested in activities with a higher return, such as learning a new skill or networking.

2. Misjudging the Value of Time Over Money

DALL-E

Those with a poverty mentality often prioritize saving money over saving time, not realizing that time is a non-renewable resource. For instance, DIY projects or driving extra miles to save a few cents on groceries might seem economical but can cost more in time than they save in money. Understanding the value of your time and when it’s worth paying more for convenience or quality can lead to better financial and personal well-being.

3. Overlooking Small Indulgences

DALL-E

Focusing solely on major expenses while ignoring small, daily expenditures is a common trait of the poverty mentality. These small purchases, like daily coffee shop visits, can add up significantly over time. Keeping track of these minor expenses and understanding their long-term impact is essential in developing a more realistic and effective approach to budgeting.

4. Neglecting Insurance and Preventative Care

DALL-E

Avoiding the cost of insurance and regular health check-ups can seem like a money-saving tactic but can lead to much higher expenses in the event of an emergency or health issue. Investing in health and property insurance, along with preventative care, is crucial in safeguarding against potentially devastating financial setbacks.

5. Underestimating the Importance of Aesthetics

DALL-E

A poverty mindset often leads to undervaluing how presentation and aesthetics can impact financial success. Whether it’s dressing for a job interview or presenting a product, appearances do matter. Investing in a professional appearance and presentation can open doors and create opportunities that far outweigh the initial costs.

6. Ignoring Mental Health and Stress

DALL-E

The constant stress of pinching pennies and worrying about finances can take a toll on mental health, which in turn can impact financial decision-making. Neglecting mental health can lead to poor financial choices and decreased productivity. Investing in mental well-being, whether through therapy, relaxation activities, or education, can have a significant positive impact on financial health.

7. Avoiding Technology and Automation

DALL-E

Refusing to embrace modern technology and automation can be a significant hindrance. Automating finances, like setting up automatic savings or bill payments, can streamline money management and prevent costly mistakes like missed payments. Similarly, utilizing technology for budgeting and investments can lead to more informed and effective financial decisions.

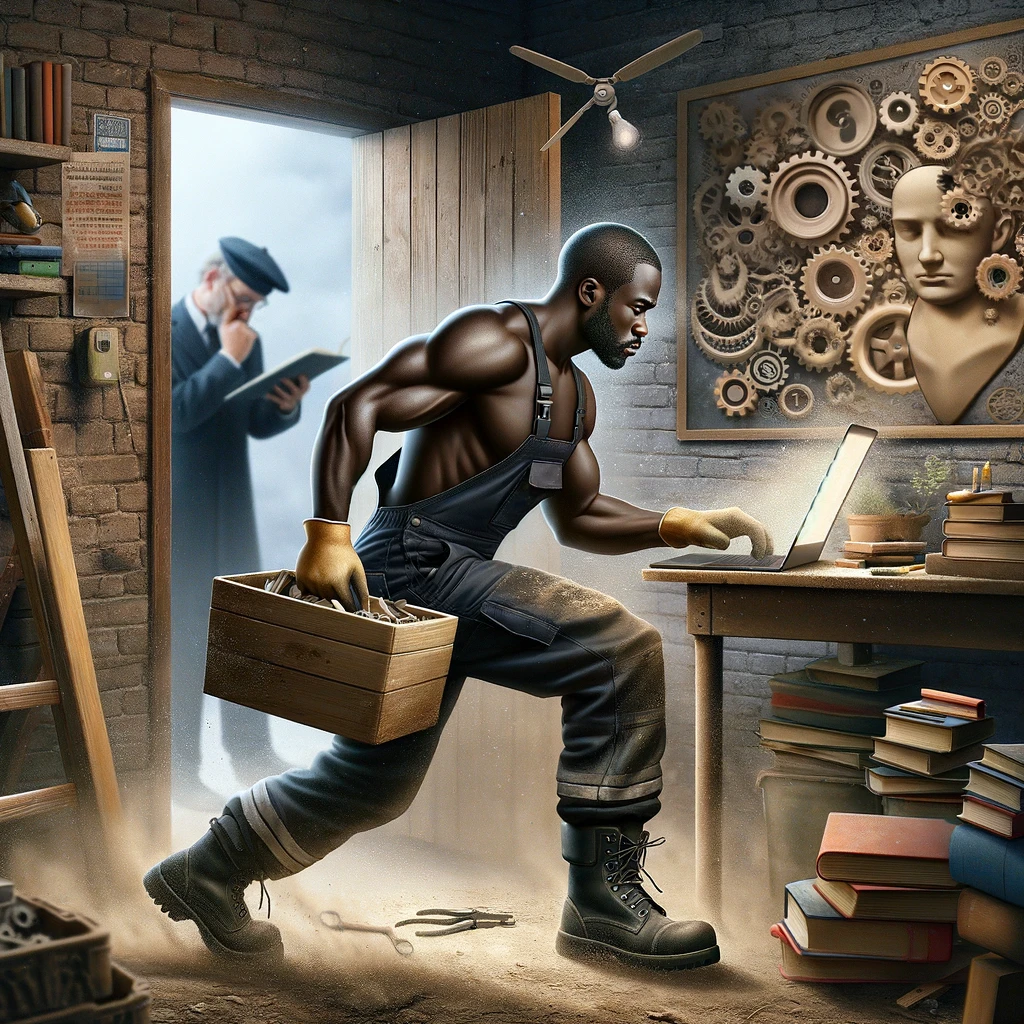

8. Prioritizing Physical Labor Over Intellectual Development

DALL-E

A poverty mindset often values hard physical labor over intellectual growth and development. While physical work is commendable, neglecting intellectual and skill development can limit earning potential. Investing in education, whether formal or through self-learning, can open up higher-paying opportunities and provide more significant long-term financial security.

9. Disregarding Environmental Sustainability

DALL-E

Ignoring environmental sustainability can be an overlooked aspect of a poverty mentality. Energy inefficiency in homes, wastefulness, and disregard for sustainable practices can lead to higher long-term costs. Adopting sustainable practices is not only good for the planet but can also lead to significant savings on utilities and resources.

10. Failing to Plan for Inflation

DALL-E

Failing to account for inflation in long-term financial planning is a critical oversight. The purchasing power of money decreases over time, so strategies that might seem safe, like keeping all savings in a non-interest-bearing account, can actually result in a loss of value. Understanding and planning for inflation is crucial in ensuring that savings and investments retain their value over time.

11. Overlooking the Benefits of Mobility

DALL-E

A poverty mentality can lead to a reluctance to relocate or travel for better opportunities. Being geographically flexible can open up higher-paying job opportunities or more affordable living situations. Sometimes, the best financial move is to relocate to a place with a lower cost of living or more abundant job opportunities.

12. Discounting the Value of Rest and Recreation

DALL-E

Finally, undervaluing the importance of rest and recreation is a common trait of the poverty mentality. Continual work without adequate rest can lead to burnout, reduced productivity, and health issues, which in turn can hurt financial prospects. Allocating time and resources for rest and leisure activities is essential for maintaining a balanced and healthy approach to life and finances.

A Holistic Approach

DALL-E

Escaping the confines of a poverty mentality is about much more than just focusing on money. It’s a holistic approach that includes valuing your time, investing in your health and education, embracing new technologies, and understanding the importance of aesthetics and mental well-being.

By recognizing and addressing these often overlooked aspects, you can transform your approach to finances and life. Remember, the journey towards financial freedom is not just about increasing your wealth, but also about enriching your entire life experience.

Start small, make informed decisions, and gradually shift your mindset from scarcity to abundance. The path to financial success is paved with continuous learning, adaptability, and the courage to step out of your comfort zone.

Tamila McDonald is a U.S. Army veteran with 20 years of service, including five years as a military financial advisor. After retiring from the Army, she spent eight years as an AFCPE-certified personal financial advisor for wounded warriors and their families. Now she writes about personal finance and benefits programs for numerous financial websites.