Once upon a time, I stood on the parade deck a mere stone’s throw from the San Diego airport. My mom, grandma and grandpa, and best friend’s sister were in the stands, but I couldn’t find them.

Eyes. Straight. Ahead.

After all the pomp and circumstance, we heard the final phrase we had been waiting to hear for nearly 14 weeks, “Marines! Dismissed!” To which we replied, “Aye-Aye, Sir!” took one step back, about face and done.

I had earned the title Marine.

One of the things we learned in the Marine Corps were the 14 leadership traits – they were beat into our brains (sometimes quite literally)– so they’ve stuck with me for almost two decades. Undoubtedly, my time as a Marine shaped who I am today, and despite the fact that I’m not active any more, I still talk with Marine buddies, and quite often reflect on my time; the acronym JJ DID TIE BUCKLE ringing in my head.

Without further ado, here are the 14 leadership traits, as taught to me by Uncle Sam, complete with their definition, and how I think they can make you a better investor:

- Judgment: The ability to weigh facts and possible courses of action in order to make sound decisions.

- Justice: Giving reward and punishment according to the merits of the case in question. The ability to administer a system of rewards and punishments impartially and consistently

- Dependability: The certainty of proper performance of duty.

- Initiative: Taking action in the absence of orders.

- Decisiveness: Ability to make decisions promptly and to announce them in a clear, forceful manner.

- Tact: The ability to deal with others in a manner that will maintain good relations and avoid offense. More simply stated, tact is the ability to say and do the right thing at the right time.

- Integrity: Uprightness of character and soundness of moral principles. The quality of truthfulness and honesty.

- Enthusiasm: The display of sincere interest and exuberance in the performance of duty.

- Bearing: Creating a favorable impression in carriage, appearance, and personal conduct at all times.

- Unselfishness: Avoidance of providing for one’s own comfort and personal advancement at the expense of others.

- Courage: Courage is a mental quality that recognizes fear of danger or criticism, but enables a Marine to proceed in the face of danger with calmness and firmness.

- Knowledge: Understanding of a science or an art. The range of one’s information, including professional knowledge and understanding of your Marines.

- Loyalty: The quality of faithfulness to country, Corps, unit, seniors, subordinates and peers.

- Endurance: The mental and physical stamina measured by the ability to withstand pain, fatigue, stress, and hardship.

Which of these should you practice while managing your investments?

Knowledge is an easy one, but which others?

I think Judgment and Decisiveness are most important in my investing plan. It’s important to know what to do (knowledge), exercise sound thinking on when to do it (judgment), but most importantly, you need to act (decisiveness). I can see many other leadership traits that would help me (and others) become better investors. This is a useful list for your investment plans and for your day-to-day interactions with others.

A lack of decisiveness holds people back too often. When you have multiple options, and they all look good, it’s important to pick one and move. In the Marines it’s a matter of life or death. Luckily for us, in investing, it’s a matter of compounding interest!

While not life or death, missing out on a few days of interest, over long periods of time, has an increasingly damaging affect on your money. Missing $100 today could be a couple thousand dollars lost during your retirement years.

Other than the ones I listed above, do you see any leadership traits that if applied would help you be a better investor?

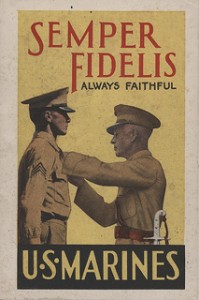

photos: Semper Fidelis – Marine Corps Archives & Special Collections; Marine Engineers Resting After Firefight – DVIDSHUB

God love you and bless you. Thank you for your service. Excellent article. Great points. Thanks for sharing. I, personally, am still working on that whole tact thing. Never have gotten the hang of it – probably never will. Not sure I’m ever going to apologize for that.

That’s funny, Mrs. Jim. I get to work with OG every day and I’m pretty sure that although he learned a ton from the Marines, tact might not have been among them…. 😉

I think decisiveness is a great trait that is transferred to investing. You can have all the knowledge in the world about a particular investment but if you’re not willing to pull the trigger and go through with it you will never make any money. Thanks for your service! The Army and Marine Corps always give each other flak, but when I served with the Marines in Fallujah they were a squared away outfight! oorah!

outfit*

I like integrity and courage…really in all aspects of life!

I would also say that “judgement” is important in investing. A lack of good judgement can put thousands of dollars at risk. Take for example investing in income producing properties. Rushing into a purchase decision without good judgement based on concrete facts and figures could put the investor into a negative cash flow situation.

Endurance is a big one too. The stock market is an emotional roller coaster. Research shows many investors get low returns by panicking and pulling out at the bottom of the market. Princeton University professor Burton Malkiel showed in his book The Elements of Investing that having the power to invest set amounts at set intervals (dollar cost averaging) beats most active investors.

I’ll go and apply these leadership traits then.