In the past several weeks, I’ve ground my axe on charts that are either misleading or actually say nothing.

Today, let’s counterpoint: I’ll show you a chart that makes sense to me AND fills me with more dread than seeing Aunt Ernestine in a swim suit.

…a rather unflattering swim suit.

I found this chart at FRED, an acronym for Federal Reserve Economic Data. This website is chock-full of charts and graphs direct from the government and financial institutions. And, as a bonus, they’re usually easy to understand.

Bonus!

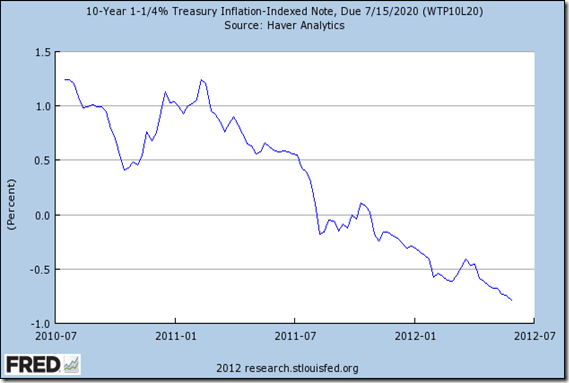

Here’s the chart I’d like to focus on today, class:

So, if you aren’t familiar with Treasury Inflation-Indexed Notes, don’t start nodding off on me! I’ll have to send Aunt Ernestine over to sit on your lap.

That woke you up.

Let’s explain what the $%!@ we’re looking at here.

As you can see on the header, this chart shows the yield-to-maturity on a 10-Year Treasury Inflation-Indexed Note.

What’s a “Treasury”?

Investments that are simply referred to as a Treasury in the U.S. are products of the U.S. Government. They’re sold at an auction. The amount of the note is fixed (you buy in $100 increments), but the interest rate is what they bid on. If nobody bids, the government will have to pay a high return to lure investors. IF lots of people bid, the government is able to sell the debt for a lower price. Initially, this debt was priced at 1-1/4%. That’s a nice win for the U.S. Government.

As an example, if you have great credit, you do this with credit cards. Instead of jumping on the first credit card offer, you examine the interest rate. If it’s higher than you want to pay, you keep searching. Essentially, you’re pitting “investors” (lenders) against each other for the pleasure of holding your debt.

What’s a Note?

A note is a ten year bond. Once the bond is issued (this one was issued in July of 2010), it’s paid off ten years later.

Do you have to wait ten years to sell your bond? No. You’re allowed to sell early, but you’ll do it on the open market.

The open market conditions produced this graph.

What Does the Graph Show?

This graph DOESN’T show you the price of the ten year bond. Instead, it cuts to the chase. If the bond is sold initially for $100 (called the Par Value), and an investor will give you $105 for it, he should already know that he’s only going to receive $100 when the maturity date comes. Therefore, it’s a simple computation: if you over or underpay, what is the true interest rate you’ll receive?

This chart shows the true rate if you purchased this 10 year note today.

In short: the price is so high you’re guaranteed to lose money.

Ouch.

Why is this Frightening?

If investors are comfortable loaning money to the government, knowing that they’ll lose money, this means that other places to invest money are even uglier.

In short, we can discern:

– There is much constenation about the financial markets now

– Lots of investors feel comfortable losing a little money with the U.S. government

From that I infer that investors think they’ll lose more elsewhere.

Is This An Opportunity?

Clearly, there is less opportunity in Treasury Inflation-Indexed Notes than there is with Aunt Ernestine. However, some investors may think that this means that the panic has gotten so high that there are obvious opportunities elsewhere.

Maybe.

Remember that the majority of traders have more money than you and I. Professional traders work from platforms that spend more money on research than we spend on our homes. If you’re looking for opportunity, it isn’t apparent in this particular graph. You’ll need to look further.

Where Do You Look Next?

This chart leads me to want to see past correlations between the 10 Year Treasury Inflation-Indexed Note market and other financial markets. By viewing these, I might be able to better discern if this is simply panic or something bigger.

More on that another day.

For today, know this:

– FRED is a good place to find charts and graphs

– Treasury note graphs can give you clues about the market overall

– You can lose money in government bonds if you buy them on the open market

Is there anything I missed here? Let’s chat about this market and investments in the comments, minions.

That is a scary chart! These days people care more about having their money returned as opposed to the return on their money.

I hope small investors understand that this is a money-losing proposition, Jason. I’m sure you’ve met investors who don’t understand that they’re just going to get their original $100 back, not the extra money they paid.

That wouldn’t surprise me at all.. it’s been ingrained into individual investors that Treasuries = safety, and most think they’ll balance out inflation in TIPs, but that’s predicated on the CPI accurately reflecting inflation, which is debatable at best..

You cracked a funny. CPI accurately reflecting inflation…..HA!

Really interesting…and scary! I thought optimism was on the rise…shows how much I know.

Me too! I thought things were getting better. Not according to prices, though.

I guess my money stays in the online savings account paying a piddly 1.25% APR, because at least then I’m not losing money.

Yeah…losing money in Treasuries is horrible.

I assume TIPS are big now then? Thanks for the links to the graphs…I like a good graph with my morning coffee.

Those are all negative too, unless you go all the way out to the 30 year, Brent. Check this out: http://online.wsj.com/mdc/public/page/2_3020-tips Look at the yields…all negative until you get to the super long term TIPS.

Wow, thanks for dumbing it down — I love learning from you! So when the yield is negative, don’t buy treasury. Right?

Amen said the choir, Kathleen! When yield is negative, that’s how much you’re going to lose. Ouch. One point, though…many investors think they’ll actually MAKE money on this, because the “stated” yield is 1 1/4%. You have to realize that when you pay $105 for something that’ll only return $100 AND get a 1 1/4% dividend, that dividend will be on $100, not on $105…not quite making up the difference.

FRED is pretty epic and awesome. Have you tried getting data out? Very simple – I wish all data-driven web sites made it that easy…

It cracks me up that a government-related agency is the most awesome data group available. I’ve barely scratched the surface on using FRED. Can’t wait to dig in more….

Another point you implied with your “if you need to sell it’s on the open market” statement is that when interest rates rise, which I’m fairly certain is likely within the next few years, unless Armageddon truly does occur, the value of those bonds on the open market is likely to plummet….

Right-o Dr. Dean! Who’s going to want a 1 1/4 percent rate bond? …and you bought it at a premium. Even more frightening….

Meanwhile, not all bonds from the US gubimint suck. I-bonds are way better (IMHO) than a 5 yr CD if you can make it through the year “probationary” period and live with the relatively low limit on how much you can buy.

I’m in at 3.06%, then I go to 2.2%, after penalty, that would be like 2.3-ish% APY. Where else today can you lock up your money for a year and get that?

If you have an emergency fund somewhere liquid to cover that probationary period (as you call it!), I love I-bonds. Because of the way they work, they’re less of an indicator of the strength of the economy, however….which is what really frightens me about the graph.

One opportunity not mentioned might be the TPS ETF… it’s an inverse index of the TIP ETF, so in theory when TIPs dip, TPS should rise… there’s not much info about TPS though as it’s a relatively new ETF and highly derivative so it’s probably not for most people. Still, it could become exciting as when the treasury bubble pops. 🙂

Interesting play, Joe! I’d never heard of TPS. I’m off to research….